E-Invoicing Exchange Summit - VIENNA, Sep 22-24, 2025

To shape the future agenda, we welcome your suggestions for presentations.

If you are interested in becoming a partner for the E-Invoicing Exchange Summit, please reach out to Alexandra Bayer.

Stay up-to-date with the latest program developments by subscribing to our newsletter.

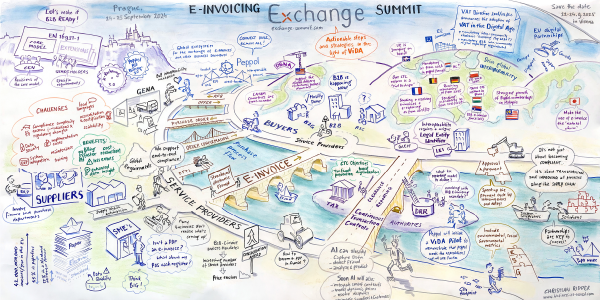

This was the Agenda 2024

TAKE A LOOK AT THE REVIEW

PRE-CONFERENCE DAY - September 23, 2024

09:30 - 12:00

Workshop A

E-Invoicing as Enabler for Proactive and Personalised E-Services in a Real-Time Economy

This workshop is targeting private sector solution developers and public sector authorities. E-Invoices are integral part of a wider context in the entire business data flow. We discuss how governments could support this smooth flow between different business events, what governments could offer back to companies and how solution providers could come along. In the Real-Time Economy concept all business data belong to the entrepreneur and their sharing is only done with the entrepreneur's consent. Data is not a by-product of business, but an asset, because the value of data increases with better use.

Businesses should be able to focus on urgent business matters, on things that really make value for the company and increase productivity, instead of dealing with various time-consuming administrative activities. So how could reporting to the state also be beneficial for the entrepreneur?

Topics to be discussed in workshop:

+ Setting the general scene

- Data is an asset, how to improve the business data quality? Service providers views on improving data quality

- What is once only principle in data management?

- Public sector request for minimal amount of data

+ Mapping business events that happen before and after an E-Invoice

- E-Invoices nor digitalisation alone will make the change, let’s look at the general picture

- Where business data is generated (Digital Product Passport, eOrder, eContract, eWaybill, E-Invoice, ePayment) and how it could be reused for reporting (VAT, Annual reporting, packaging report, sustainability reporting etc), statistics and more

- What happens if there will be gaps in the data movement?

- Different views on architecture, data exchange, public sector collaboration with service providers

+ Launching proactive, personalised and value added services

- Which data-based services could govenrments provide to companies, examples of Business Viability Index and Tool for businesses to boost data-driven business decisions and KYC solution

- How to maximise the opportunies to create data-driven business environment by implementing data interoperability for business reporting, different AI-solutions and other digital services targeted to entrepreneurs?

Supported by

Pirjo Ilola Finnish State Treasury, Senior Finance Administration Specialist

Hannu Kivinen Finnish State Treasury, Senior Specialist, Peppol-authority

Tomi Rusi Finnish State Treasury, E-invoicing Specialist

Pasi Sinervo Finnish Tax Administration, Developer and Tax Auditor

Workshop conducted by Kristi Aruküla and Viktoria Bõstrjak-Butorina Digital Economy Department, Ministry of Economic Affairs and Communications Estonia

12:30 - 15:00

Workshop B

GENA Academy Essentials: Everything You Always Wanted to Know About E-Invoicing, but Were Afraid to Ask

Delve into the enigmatic world of E-Invoicing, where seemingly humble administrative documents wield unparalleled influence. This session will unravel the complexities of E-Invoicing, covering essential topics including:

+ Terms and Abbreviations: Decipher the jargon and acronyms.

+ E-Invoicing as a Business Process: Explore how E-Invoicing transcends mere paperwork to become a cornerstone of modern business operations.

+ Why Small Businesses are the Elephant in the Room: they aren't at the table, yet they dominate the debate.

+ Why Governments Care (A Lot): Understand why tax and other regulators simply cannot leave the invoice alone.

+ Supporting Characters: Meet the other crucial actors that contribute to the E-Invoicing ecosystem.

+ Models and Frameworks: Discover the diverse array of business and regulatory models and frameworks that shape E-Invoicing.

+ Regional, Sectoral, and Cultural Differences: how regional, sectoral, and cultural factors influence its implementation and adoption.

+ Global interoperability: The GENA/Peppol incubation project

Workshop conducted by Richard Luthardt Board Member German Chapter, Michel Gilis Head Working Group Interoperability, Henrik Möller Member Executive Committee and Ellen Cortvriend Member Working Group Public Policy & Compliance Working, GENA - Global Exchange Network Association

Meeting 1 (exclusively for government officials)

Potential E-Invoicing and DRR Implementation Trajectories under ViDA

Attendance exclusively reserved for government officials

State of CTC in the EU and Globally

Nazar Paradivskyy Global Subject-Matter Expert, Leader of OpenPeppol CTC Community and Member of GENA Public Policy and Compliance Working Group

Insights into Current Work of OECD

Eduardo Jiménez Adviser VAT Unit - Centre for Tax Policy and Administration, OECD

Current State of Play in Selected Countries that are Currently Implementing CTCs

NSG ViDA pilots: Fredrik Andersson Carlö Swedish Tax Agency

Finland: Pasi Sinervo Finnish Tax Administration

Belgium: Wouter Bollaert Ministry of Finance of Belgium

Greece: Apostolos Boutos Greek Tax Agency

Open Discussion

+ Review and discuss results from pre-session polls

+ Discuss practical aspects that ViDA is not talking about

+ Information on useful international activities on this matter

Meeting conducted by Nazar Paradivskyy Global Subject-Matter Expert, Leader of OpenPeppol CTC Community and Member of GENA Public Policy and Compliance Working Group

15:30 - 18:00

MEETING 2

ViDA - why wait? Act now!

Why businesses and governments should get started now:

+ future-proofing with Peppol

+ Cross-border and domestic requirements

+ Invoice specifications, exchange methods, and governance

+ Understanding the landscape

+ Benefits for businesses and governments

Meeting conducted by Steve Graham Market Development Lead, OpenPeppol, Lefteris Leontaridis Operations Manager, OpenPeppol and Nazar Paradivskky VP Regulatory Affairs, Pagero and Leader of the OpenPeppol CTC Community

18:00 - 21:00

ICEBREAKER RECEPTION supported by Avalara

Your networking experience starts right here. All participants and speakers are invited to attend the Icebreaker Reception and to pick up their badges for the two conference days.

conference day 1 - September 24, 2024

09:00 - 09:15

Welcome and Opening

Johannes researches, organizes and runs knowledge and networking platforms that help the industry to benefit from new technologies and cope with changing legal and regulatory frameworks. His events make sure that all stakeholders learn, discuss and network with like-minded experts, practitioners and thought leaders. His main focus lies on E-Invoicing since 1999, carrying out the E-Invoicing Exchange Summits in Europe, Asia and the US, the E-Rechnungs-Gipfel in Germany, and the Swiss Payment Forum in Zurich.

Read more on LinkedIn

Johannes von Mulert Founder and Chairman E-Invoicing Exchange Summit

09:15 - 09:45

LATEST MARKET STUDY

Figures, Data, Facts: The Latest Developments in E-Invoicing Worldwide and Their Significance for Europe

In his presentation, Marcus Laube will present the latest figures, data, and facts from his cutting-edge market study, "The Global E-Invoicing and Tax Compliance Report: Watch the Tornado!" He will place the current developments in Europe within a global context and demonstrate how companies can optimally position themselves for electronic invoicing.

Marcus Laube CEO, billentis

09:45 - 10:15

Latest Updates on ViDA

Agustín Míguez Pérez Policy Officer, VAT Unit, Directorate-General for Taxation and Customs Union (TAXUD), European Commission

10:15 - 10:45

Global Update on Peppol

André Hoddevik Secretary General, OpenPeppol

E-Invoicing Providers & Business - Balancing Local and Global Needs in E-Invoicing & E-Reporting

As E-Invoicing continues to evolve, organizations must strike a balance between local nuances and global efficiency. We will delve into the intricacies of E-Invoicing across borders applicable for both business and E-Invoicing providers. We will cover practical issues that companies and E-Invoicing providers encounter when supporting and implementing new mandate. We will explore practical strategies for harmonizing local compliance requirements with global business and providers imperatives and overs come the practical issues.

Kamila Ferhat Principal Product Manager, E-Invoicing & Live Reporting and

Meike Le Roux Director, EMEA Business Development, Avalara

Connected & Automated Business - More than just E-Invoicing

The session will look beyond compliance and explore the business benefits that flow from participating in an integrated E-Invoicing network.

Sage will present its recent research which brings together insights from over 9,000 European SMEs. And highlights how adopting E-Invoicing can lead to significant annual savings of around €13,500 for these businesses by nearly halving the time spent processing invoices. Explore its broader impact on EU labour productivity and how E-Invoicing acts as a stepping stone for further SME digitalisation.

Adam Prince Global Head of E-Invoice, Compliance & Embedded Finance Strategy, Sage

Four months to go: Latest Update on B2B Mandate in Germany

Ivo Moszynski Chair of FeRD (German Forum for Electronic Invoicing) and

Richard Luthardt Board Member German Chapter, GENA and Member of the Board of VeR (German E-Invoicing Association)

The CIAT Digitalization Classification Matrix - Update

The Digitalization Dialogue under CIAT is working on a project around definitions and categorization of E-Invoicing, continuous transaction controls and other forms of digital reporting or e-audit, to create a Digitalization Classification Matrix. The purpose is to allow stakeholders in the field to use a common vocabulary and categorization of regulatory approaches. Based on this normalization, it will become easier to have a conversation about opportunities and challenges towards regulatory harmonization and interoperability.

Anna Norden Principal, Regulatory Affair, Sovos

13:45 - 14:30

Panel Discussion

International Interoperability for E-Invoicing

Agustín Míguez Pérez Policy Officer, VAT Unit, Directorate-General for Taxation and Customs Union (TAXUD), European Commission

Hiroyuki Kato Director, Digital Agency and Cabinet Secretariat, Government of Japan

Dolf Kars Board of Directors, Digital Business Network Alliance (DBNA)

Nazar Paradivskyy Global Subject-Matter Expert, Leader of OpenPeppol CTC Community and Member of GENA Public Policy and Compliance Working Group

Irena Rivière-Osipov Team Leader for EU E-Invoicing Policy, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs (DG GROW), European Commission

Moderated by: Marcus Laube Secretary General, GENA - Global Exchange Network Association

14:30 - 15:15

Roundtable Sessions

Discuss the most pressing business-relevant topics with your peers and gain valuable information.

1. How to Become a Partner Dematerialisation Platforms (PDP) in France

Partner Dematerialisation Platforms (Plateformes de Dématérialisation Partenaires - PDP) are service providers that have been certified by French government. They are entitled to issue and receive E-Invoices directly with other service providers who are certified as PDP, without going through the Public Invoicing Portal (PPF).

As a partner of the tax authorities, PDP also handle directory updates, e-reporting and compliance checks.

Lucien Gimenez Trainer and Expert in Audit and E-Invoicing

2. E-Invoicing Reporting Platform in Germany

Richard Luthardt Board Member German Chapter, GENA - Global Exchange Network Association and

Ivo Moszynski Chair of FeRD (German Forum for Electronic Invoicing)

3. The Role of Open-Source Software in the E-Invoicing Industry

Juan Moliner Co-Founder, Invopop

4. Q&A Session on Technical Aspects of Applying the 4 Corner and 5 Corner Model in Peppol

Philip Helger Technical Expert, OpenPeppol

5. What is the Present and Expected Interplay Between National E-Invoicing Systems and a Potential Supranational System for Cross-Border E-Invoicing Exchange?

Paola Olivares Research Director International Observatory on eInvoicing, Digital Innovation Observatories School of Management, Politecnico di Milano

6. Unlocking the Potential of Real-Time Invoice Data: Benefits for Governments, Businesses and Beyond

Kirsty Kerr Director of Product Management and

Lianne Bowker Senior Product Marketing Manager, Thomson Reuters

7. Factur-X via Peppol

Cyrille Sautereau President, National Forum for Electronic Invoicing and Electronic Public Procurement (FNFE-MPE) and Daniel Vinz AWV (Working Group for Economic Administration)

8. Pushing the Boundaries of Enhanced B2B Interoperability via Peppol: GENA/Peppol Incubation Project

Michael Walther Project Office to the Peppol/GENA B2B Interoperability Incubation

9. Key Success Factors for a Global E-Invoicing Strategy

Gert Eichberger Director Localization Product Management, SAP

10. Poland vs. Germany - Centralized vs. Decentralized E-Invoicing System: Who Wins and Why?

Michal Kacperek Business Solutions Consultant, Comarch

11. AP and E-Invoicing: How Business Process Outsourcing Can Help Companies Maximise the Benefits of Electronic Invoicing

Federico Campomori E-Invoicing Partner Manager and

Angela Persano BPO Manager, IDC - Indicom Document Care

Watch video message

Latest Update from CEN

In his presentation Lars will give a brief update on the current activities regarding the EN 16931-1 and other activities including:

+ New features to EN 16931-1

+ How to deal with extensions in the future

+ General timelines

Dr. Lars Rölker-Denker DIN representative to CEN TC 434 „Electronic Invoicing“

Update on E-Invoicing in Belgium

Wouter Bollaert Advisor, Federal Public Service Finance (Belgian Tax Authority)

Preparing for E-Invoicing from a Finance, IT, and Tax Perspective

This presentation will emphasize the need for companies to think broadly and strategically about these changes to avoid potential disruptions to business. It will highlight the challenges of transitioning to E-Invoicing and the country-specific approach that businesses will need to take. It will address the importance of implementing solutions, discuss the risks associated with E-Invoicing in different jurisdictions and the need for businesses to be aware of potential pitfalls.

+ Embrace E-Invoicing changes strategically to ensure smooth operations

+ Acknowledge the time-consuming nature of implementing country-specific E-Invoicing solutions

+ Overcome challenges in successful E-Invoicing adoption

Gunjan Tripathi Director Solutions Marketing, Vertex and

Chris Newman Senior Product Manager, E-Invoicing, ecosio

Centralized E-Invoicing in Poland and Serbia: E-Invoice as a Key Element of Comprehensive Business Processes

+ The future is already here: We know that E-Invoicing’s true value lies not in the invoice itself but in the process it completes.

+ Poland and ViDA (KSeF): As a digital frontrunner in the EU, Poland is preparing for ViDA. We’ll take you behind the scenes and offer a full view of B2G and B2B E-Invoicing. Find out what’s happening with the delayed KSeF.

+ Serbia sets new standards: Serbia successfully adopted the Italian model in January 2023, paving the way for others.

+ Turn regulatory mandates into opportunities: Discover how to leverage new obligations to gain a business advantage!

Tomasz Kuciel Director of E-Invoicing and Digital Compliance, EDITEL and

Karlo Mikelić Regional Sales Manager in Panteon Plus Belgrade, Board Member of GS1 Serbia

Watch video message

16:55 - 17:25

The Power of Openness and Innovation in E-Invoicing

Lianne Bowker Senior Product Marketing Manager, Thomson Reuters and

Nazar Paradivskyy VP Regulatory Affairs, Pagero

18:00 - 22:30

Networking Dinner supported by Thomson Reuters

All participants and speakers are invited to enjoy dinner and refreshments in a casual atmosphere. Use this perfect opportunity to intensify your business contacts and grow your network.

conference day 2 - september 25, 2024

National E-Invoicing and CTC Solution

+ eFaktura World: a solution for different government models

+ Benefits for E-Invoicing

+ Benefits for governments of using information extracted from E-Invoicing

+ Automated VAT reporting

+ Anti-fraud system with AI

+ Use case Serbia

Boris Jevtić Chief of International Business Operations, Unifiedpost Group and

Vojislav Simić Consultant of the Ministry of Finance in the field of E-Invoicing

Integration of eFTI and E-Invoicing

+ What is Regulation EU No 2020/1056 on electronic Freight Transport Information (eFTI)?

+ The eFTI Regulation implementation and application timeline

+ The EU eFTI Exchange environment

+ The opportunity to integrate eFTI with E-Invoicing

Rudy Hemeleers 51Biz Luxembourg, member of the EU DG Move DTLF (Digital Transport and Logistics Forum) and member of the coordinating eFTI Expert Team of the EU funded eFTI4EU consortium

The Role of E-Invoices in Business Strategy: Unveiling the Hidden Value of Data

Enrico Liverani explores the future of the E-Invoicing market, increasingly adopted globally. He highlights the E-Invoice's strategic importance beyond its administrative function. Key points include regulatory compliance, administrative and fiscal benefits, payment facilitation, and technological innovation through process automation. Liverani also touches on the potential ESG impact of E-Invoices, showcasing their broader value for businesses.

Enrico Liverani Chief Consulting & Key Account Director, Digital Technologies

Unlocking the Benefits of a Secure Payments Ecosystem: How the LEI can Boost Interoperability and Trust in E-Invoicing

Learn how the payments industry is deriving value from the LEI in cross-border payments by exploring the world of E-Invoice reconciliation and how the LEI, and its digital twin the vLEI, enable verification of the sender’s identity beyond national borders. The logic behind including the LEI in both E-Invoices and payment messages, is simple: when it is added as a data attribute, any originator or beneficiary legal entity can be precisely, instantly, and automatically identified across borders facilitating both trust and automation.

Nuria Vegas Global Legal Entity Identifier Foundation (GLEIF)

E-Invoicing in France: Status Update Including Interoperability with the PEPPOL POC

Cyrille Sautereau President, National Forum for Electronic Invoicing and Electronic Public Procurement (FNFE-MPE)

The Exchange Framework of The Digital Business Networks Alliance (DBNA) is Up and Running

Dolf Kars Board of Directors, DBN Alliance

Invoice Data: Services Based on Obligation in Hungary

Sándor Gazda Head of Unit, Risk Analysis and Data Science Department, Tax and Customs Administration of Hungary

Future-Proof Your Compliance - How Best-in-Class Companies Ride the Mandate Wave

Embark on a journey of strategic foresight with thought leader Sampo Salmi as we navigate the impending wave of E-Invoicing mandates in today's dynamic business terrain. Instead of mere reaction, discover the unparalleled benefits of proactive compliance preparation.

Join us for an insightful exploration into the transformative power of staying ahead, offering strategic insights, practical solutions, and a roadmap to elevate your business from mere compliance to a true competitive advantage.

Sampo Salmi Senior Sales Advisor, Basware

The Hungarian CTC Ecosystem and its Service Mindset

+ High level introduction of the Hungarian CTC ecosystem (Online Cash Registers, EKÁER, RTIP) and their benefit on the national economy

+ Introducing the service mindset behind them

+ Introducing the service RTIP provides free of charge, and the services the market builds on them, creating value

+ Mentioning the e-VAT system, which is a 'natural evolution' of such service mindset which provides pre-filled VAT returns from 3 distinct data sources

+ DRR implications, possible services on pan-european level

Csaba Kocsis Strategic Solution Architect, i-Cell Mobilsoft

Beyond Compliance: E-Invoicing as a Catalyst for Supply Chain Transformation

An invoice starts with an order. An order starts with an agreement to enter into a business relationship. It's time to recognize that E-Invoicing isn't just about legal compliance. In this presentation, we’ll explore an alternative definition of compliance that encompasses the full nature of transactions. We’ll discuss the different approaches required for mandatory versus voluntary E-Invoicing scenarios and why E-Invoicing alone can't drive true business transformation. After all, it's just one part of the entire value chain. Join us to learn how E-Invoicing can be a catalyst for supply chain transformation and unlock substantial business benefits.

+ Understanding the importance of aligning E-Invoicing with trading partner and business require-ments in addition to legal compliance requirements, and what this means for companies

+ Key considerations for implementing E-Invoicing, whether mandatory or voluntary, and the (unspoken) relationship with EDI

+ Using E-Invoicing as a potential accelerator and bridging the gap with the broader value chain to drive business transformation by addressing real business challenges

+ Strategies for quick and efficient onboarding beyond high-volume trading partners

Courtney Yocabet Product Manager and

Linda Odufuye Director Product Management, SPS Commerce

13:45 - 14:15

Industry Analysis: The Good, the Bad and What’s Next for the Industry

In an industry that's evolving at blistering speed, get a deep dive analysis of the past, the present and what the future holds for our industry. We will be challenging industry buzzwords, silos and barriers to progress.

In this session, we will:

+ Explore what is said versus what is meant - how confusing jargon and inconsistent definitions are stifling progress

+ Debate perspectives from each corner of the industry, including suppliers, buyers, technology partners and regulators. What challenges does each face and what outcomes do they ultimately seek?

+ Examine how we are all part of the same ecosystem, where trade, CTC compliance and digitization actors have a shared purpose and increasingly shared means

Phil Bailey Head of Network Expansion, Pagero

14:20 - 14:50

The Strategic Approach to E-Invoicing & E-Reporting Projects

The introduction of domestic E-Invoicing and real-time reporting obligations is a critical issue for companies worldwide. Approaching this topic strategically, with the right stakeholders at the table and at the right time can support companies to minimize their costs, optimize their processes and ensure timely compliance. Failure to address these requirements promptly can lead to significant disruptions and will imply important changes in the way businesses deal with their customers, internal stakeholders and the tax authorities.

During this session, we'll talk about:

+ What's new and what's next:

Update and overview of recent global changes and upcoming requirements

impacting businesses

+ Preparation strategies - insights from the field:

- Our experience on what businesses are currently doing to prepare for the upcoming

requirements

- Example project plan for effective implementation of your e-invoicing and

e-reporting project

+ Selecting the right software provider:

Key criteria businesses are considering when selecting an external software provider

+ Practical use cases:

Real world examples demonstrating successful E-Invoicing and

E-Reporting implementations

Brecht van Petegem Manager Indirect Tax Technology, Global E-Invoicing and E-Reporting CoE Lead and Tea Skarpa Director Indirect Taxes I Value Chain Transformation, PwC

14:55 - 15:40

Panel Discussion

Actionable Steps and Strategies in the Light of ViDA: What’s the Big Deal for VAT Departments?

Michael Reithmaier Head of Tax, REWE International

Kurt-Josef Mörzl Domain IT Architect Tax, Siemens

Julius Eickhoff EDI Specialist, Würth

Moderated by: Bianca Wöhrer Lecturer in Tax Law, FH Campus Vienna and Delegate to CEN TC 434 and

Alexander Kollmann Head of Transactional Tax Reporting, Schwarz Dienstleistungs KG (Lidl, Kaufland) and User-Group TaxVoice