Review E-Invoicing Exchange Summit Vienna 2021

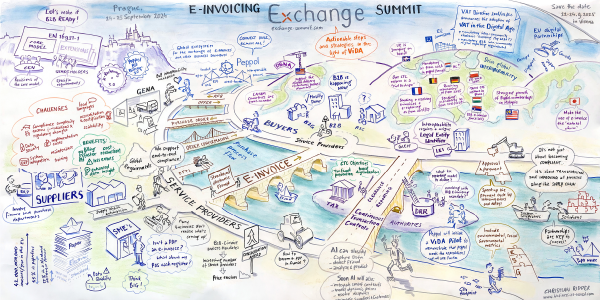

Download Graphic Recording 2021 . Copyright Christian Ridder, business-as-visual.com

E-Invoicing Exchange Summit 2021 in Vienna

The E-Invoicing Exchange Summit took place in Vienna from September 27 to 29, 2021. After over one year of hault for physical events due to Covid-19, more than 100 persons from across Europe came together in person in Vienna (under the Austrian "3G rule") and another 100 attended remotely in this hybrid event in order to discuss the latest developments in E-Invoicing.

We started with a special day dedicated to a country comparison for E-Invoicing and Continuous Transaction Controls. Also, in the conference programme this topic has been well represented and we talked all things CTC. It became clear there is a will amongst industry and service providers to achieve global and European consistency.

Other presentations gave updates on the global developments in Peppol, for example with Japan having become the latest Peppol authority, shed light on the current status and next steps of E-Invoicing in France, Hungary, Germany, and Portugal. Another highlight was to get the latest insights from European Commission Study on "VAT in the Digital Age", explaining what options are in place for a harmonised European tax reporting scheme. This is to name just a few of the highlights, further below you will find the entire agenda.

Once again, this E-Invoicing Exchange Summit has been a great space where the E-Invoicing and E-Reporting community exchanged ideas and networked. Numerous excellent discussions and face-to-face talks took place with customers, partners and policy drivers on the convergence of the different E-Invoicing and E-Reporting models and how all can help reduce complexity and manage the transition to E-Invoicing and Continuous Transaction Controls.

You may view all key-topics in the new “Big Picture of E-Invoicing" drawn by Chris Ridder - an entertaining and compact graphic recording on www.exchange-summit.com/insights/graphic-recording.

The positive feedback was overwhelming with everyone being grateful for the opportunity to participate and share knowledge with each other. Now our global E-Invoicing journey will continue in 2022 in Miami May 9-11, Berlin June 20-21, Lisbon September 26-28, and in Singapore (date to be announced). We will be happy to welcome you there!

Workshop: Monday, September 27, 2021

10:30 - 16:30

Start your participation at the E-Invoicing Exchange Summit with attending the pre-conference workshop.

DEEP DIVE INTO E-INVOICING AND CONTINUOUS TRANSACTION CONTROLS: A COUNTRY COMPARISON

During this workshop we aim to give an understanding of the current and future challenges in the global landscape relating to e-invoicing / e-reporting, an understanding of the existing IT solutions, complexity and sustainability to develop and maintain requirements and to determine required assistance and expertise. In addition our guest speakers will provide the audience with some valuable insights on their country specific recent developments.

+ Welcome and introduction

+ Global overview of recent and future trends on e-invoicing & e-reporting

+ Country comparison - Different key country developments:

- Australia & New Zealand, Japan, China

- Poland, France, Serbia, India, Saudi Arabia, US

+ Overall conclusions on country comparison

+ How to respond and update various systems and processes in a timely manner to ensure it remains legally compliant

+ Key takeaways

Christoph Zenner Partner, Ellen Cortvriend Director and Brecht Van Petegem Manager, PwC, Belgium together with several guest speakers

Conference Day 1: Tuesday, September 28, 2021

E-Invoicing and Continuous Transaction Controls in the Digital Age

+ Global overview of recent and future trends and requirements on E-Invoicing, E-Reporting and E-Audit requirements

+ Country updates: Serbia, Hungary, Poland, Croatia, Saudi Arabia, Egypt, India

+ Digital tax compliance and exchange of information

+ How these recent trends interact with a company's broader AP/AR process

Christoph Zenner Partner and Ellen Cortvriend Director, PwC, Belgium

Global Developments in Peppol

+ Increasing adoption in Europe and beyond

+ Strengthening Peppol through:

- the revised Peppol Interoperability Framework

- new service domains

- global interoperability specifications

André Hoddevik Secretary General, OpenPeppol, Belgium and Toshiyuki Zamma Head of International Strategy and Hiroyuki Kato Director for Planning and Coordination for eInvoice, Digital Agency, Government of Japan

Current status of B2G and B2B E-Invoicing in France

+ Update on the French plans to make B2B E-Invoicing mandatory (2023-2025)

+ Implications of the E-Invoicing reform for editors and software providers

+ An E-Invoicing structured data dictionary for France

+ Ordinance to be issued in September 2021

+ Platforms and certification: a way to E-Compliance

+ Reliable Audit Trails

+ Recent developments of B2G E-Invoicing in France with Chorus Pro

Lucien Gimenez Trainer and Expert in Audit and E-Invoicing and Bruno Saurel Chairman, INFOCERT - technical secretary of AFNOR Certification and specialist in software certification, France

Corporate´s pain with unharmonised E-Invoicing and Tax Reporting - a European Cross-Comparison

+ The five fingers of the taxman: tax transparency vs. business efficiency

+ General requirements from the perspective of multinational companies

+ Why should tax reporting be linked to E-Reporting?

+ Need for standardization or harmonization at European level

+ How do we train interdisciplinary know-how carriers in the field of tax/IT?

Alexander Kollmann Project Manager Tax International / Tax Technology, Schwarz Dienstleistungs KG (Lidl, Kaufland), Germany

Latest Insight from European Commission Study on "VAT in the Digital Age"

In October last year, the European Commission launched an external study on 'VAT in the Digital Age'. The study focuses on three distinct but interrelated areas:

+ Digital Reporting Requirements

+ VAT treatment of the platform economy

+ Single VAT Registration and Imports One Stop Shop.

This presentation focuses on Digital Reporting Requirements. It outlines the approach to the study, the current issues in the area of reporting mechanisms and e-invoicing, the policy alternatives currently analysed, as well as the forthcoming consultation activities.

NB: The external study does not prejudge on any future Commission proposal in the area.

Giacomo Luchetta Economic Analyst, Economisti Associati and author of the EC study "VAT in the Digital Age", Italy

Billing Experience: How technology may help in transforming e-invoices into an engaging moment

+ How billing experience may impact the relationship with your customer

+ How is it possible to deliver a great billing experience in CtC context and prevent complaints and bill-shocks

+ Why E-Invoices interoperability and standardization between foreign countries is strategical for billing experience

+ Six Trends to be considered from e-invoice to billing experience

The transition to electronic invoicing has paved the way for both the digitization of companies, which have found themselves experimenting with specific digital technologies and solutions in very different fields, as it has led all companies to change their approach and ask themselves how to improve the relationship with customers. Hence the need to rethink the moment of billing: instead of dealing with it as a simple mandatory and regulation fulfillment, it is better to integrate it into the customer experience offered to its customers, so that they live it better and, consequently, have a better relationship with the companies themselves. To take all these steps, which are certainly not easy, it is necessary to constantly work on the billing phase, file it, improve it, to keep it always “current” and in step with new technologies and the new needs of customers and suppliers.

Francesco Goldoni Product Manager Paperless Experience, Doxee

Collaboration without trust - The future of intra-community reporting

Because reporting requirements are growing rapidly, more data is collected by governments than ever before. Agreements and systems like VIES, Intrastat and TNA could cause your confidential data to end up all over Europe. How does this work? And are there any ways in which tax authorities in different countries can collaborate *without* seeing your data? In this presentation you will learn - and perhaps even participate - to collaborate without trust.

Sascha Jafari CEO Summitto, The Netherlands

Data-driven Compliance and Technology Projects

When you implement an E-Invoicing solution, a lot of things can go wrong. This session will provide some practical guidance on implementing tax technology projects, focusing on best practices and common pitfalls.

View video

Aleksandra Bal Indirect Tax Technology & Operations Lead, Stripe, The Netherlands

Automating Invoice processing with RPA and AI: How and When

New technologies as RPA (Robotic Process Automation) and AI (Artificial Intelligence) are becoming more and more relevant in the invoice management, bringing efficiency and automation to the process. Looking at successful business cases, in this presentation you will learn how and when RPA and AI can be implemented.

Enrico Liverani Chief Consulting & Key Account Director, Digitechs, Italy

Game-Changer: E-Invoicing. Build on experience.

+ 100+ e-invoicing projects: Sharing proven keys to success

+ Harnessing the potential of digitalization

+ Why ground rules are important

Richard Luckow Key Account Manager, Branch Manager, xSuite Group, Germany

Where will the Growth in Tax Technology be?

Kid is the VP of Product Management for EMEA at Avalara. Kid is a Computer Science graduate with thirty years of IT experience in a broad range of disciplines from development and product management through systems implementation, sales support, and software sales management. Kid has worked for Xerox, American Express, Sabrix, and Thomson Reuters as well as multiple technology startup companies. In the last seventeen years, he has specialized in international indirect tax automation.

Christian is working in e-invoicing environment since 2005. At Inposia he is responsible for sales management since 2016. Before he’d been 9 years at SAP in several positions and 2 years at Atos Origin as Senior Sales Manager.

Christian Marreck VP Sales INPOSIA by Avalara and Kid Misso VP Product Management EMEA Avalara

How Digital Can Tax Law Get?

The digitization of tax authorities' work processes has taken place for half a decade. According to several reports a large variety of e-invoicing, e-filing, e-accounting, e-matching, e-auditing, and e-assessments currently forms the standard mode of operation in many countries worldwide. They all use tools like Robotic Process Automation, Process Mining, Distributed Ledger Technology like Blockchain and other types of BI and AI technologies. Hence it is evident that TaxTech is one of the innovative enablers of the ongoing change in the field of tax and customs. In this presentation you will learn and discuss important aspects, such as:

+ What is behind this technology and how can managers benefit from it?

+ What type of knowledge pieces are needed to get prepared?

+ Does the market need / demand for specific educational programs?

+ Who will be the "new kid on the block“ to be able to utilize this trend?

+ How does a common use case look in the context of value-added tax?

Prof. Dr. Robert Risse Institute for Austrian and International Tax Law, Vienna University of Economic and Business

Conference Day 2: Wednesday, September 29, 2021

Global Interoperability Framework - Collaboration in the Connected World

eDelivery Networks are becoming the common railroads for world-wide eInvoice adoption. The GIF is working to establish common implementation guidelines for global use. Learn more about the GIF work plan in this presentation.

+ Updates on pilots and deployments

+ Business Justification for eDelivery

+ Industry Profiling

+ Governance by Agreement

+ Importance of tracking CTC

+ Global deployment GIF-to-GIF

+ The 12 month work plan: Profiles, Model Agreements, Use of Industry specific formats, Deploying eDelivery in Pharma

Chris Welsh Chair Global Interoperability Framework Workgroup and Board Member ConnectONCE, USA

Global E-Invoicing Project at Greiner Bio-One

+ Use of a central platform to meet local e-invoicing requirements

+ Examples:

- B2T - NAV Hungary

- B2G / B2B - FatturaPA Italy

- B2T - SII Spain

- Peppol

+ Successful implementation together with SEEBURGER

View Video

Adelheid Eßl IT Application Engineer, Greiner Bio-One International, Austria

Order-X: The current status and next steps

The moderators of this round table will provide information on the current status of the topics Order-X and Factur-X/ZUGFeRD. Cyrille will use the latest developments in France to illustrate why a hybrid format in particular represents an important building block for the digitization of business processes for small and medium-sized enterprises. In the further course, Daniel will briefly present the common basis of these standards, the SCRDM "Supply Chain Reference Data Model", show the advantages of using Order-X and Factur-X/ZUGFeRD and finally outline what plans are already in place for the coming months.

Cyrille Sautereau Head "French Forum National de la Facture Electronique et des Marchés Publics Electroniques" (FNFE-MPE) and Daniel Vinz Technical advisor "Forum elektronische Rechnung Deutschland" (FeRD) at the Arbeitsgemeinschaft für wirtschaftliche Verwaltung e. V. (AWV)

Mandatory E-Invoicing to Authorities

Mandatory E-Invoicing to the public sector and statutory reporting - are they all converging in the future?

The borderline between the different e-invoicing and e-reporting models is blurring, with countries evolving or extending from one model to the next one:

+ from B2G to B2B e-invoicing

+ from statutory reporting to continuous transaction controls

+ from SAF-T to e-invoicing

+ from e-invoice reporting to e-invoice distribution

Let’s exchange on strategies for taxpayers and service providers to continuously evolve in such a dynamic environment.

Martin Lin and Olivia Vorstheim SAP

Cooperation in Taxation: Transparency and Efficiency in Hungary

+ Online invoice reporting as an obligation

+ Services of Hungarian Tax Administration based on the obligation

+ How the taxpayers use the services: benefits and outcomes

+ Cooperation between the NTCA and the business

+ Online invoice report as an e-invoice

Attila Mizsányi Head of Unit and Szabolcs Czöndör Head of Department, National Tax and Customs Administration, Hungary

SAF-T – A Way Beyond Tax Audits

+ Why SAF-T is important and how it may help both taxpayers and tax authorities

+ Insights into projects based on SAF-T aiming to:

- Simplify: By pre-filing or simplifying tax declarations and enabling the principle "data only once"-interoperability with other government bodies

- Prevent: By helping taxpayers to voluntary comply avoiding audit procedures

- Detect and Mitigate: By enabling a better and faster risk analysis and by increasing difficulties in tax fraud and evasion, ensuring tax equity and fair competition

Ana Mascarenhas Head of Tax Audit Department Portuguese Tax and Customs Authority, Portugal

Fiscalization could be easier

There is a big movement in the market around fiscalization. Germany has just gone fiscal, shortly before Austria and France. And the trend will continue.

+ Let's create a business map and show where to put E-Invoicing and where we should put fiscalization

+ Let's continue with this geographical map and get an overview about fiscal countries in Europe

+ Let's continue with a map of challenges retailers have in the international fiscal environment

+ Let's learn why those challenges are there

+ Let's finally discuss how can we make it better!

View Video

Milan Lazarevic General Manager, Fiscal Solutions d.o.o., Serbia

E-Invoicing in Germany - Status Quo and Outlook

Ivo Moszynski will present the current status and ongoing activities on the topic of E-Invoicing and E-Procurement in Germany. In his presentation he will also cover aspects of current developments regarding Order-X and ongoing discussions about future E-Invoicing mandates and a possible implementation of a clearance model.

Ivo Moszynski Chair of FeRD (Forum for Electronic Invoicing), Germany

The Voice of the Industry

+ Looking back at two days of conference: what were the major issues

+ 10 years of EESPA: most important trends and evolutions

+ EIN (EESPA Interoperability Network): update on a major breakthrough for the industry

+ Public Policy and Compliance: current challenges and opportunities for e-invoicing

+ Looking into the crystal ball for the next 10 years of EESPA

View Video

Michel Gilis (AdValvas): Chair of EESPA Interoperability Working Group

Marcus Laube (Unifiedpost): Co-chair of EESPA

Christiaan van der Valk (Sovos): Chair of EESPA Public Policy and Compliance Working

Moderator: Erik Timmermans Senior Executive Advisor of EESPA

OpenPeppol Developments

+ Continuous Transaction Controls - Peppol CTC from project towards business-as-usual

+ Peppol International Invoice - towards global interoperability

Nazar Paradivskyy Peppol CTC Project member and Georg Birgisson Expert with the OpenPeppol Operating Office and Koichiro Okamoto Chairperson E-Invoice Promotion Association (EIPA) of Japan and Lefteris Leontaridis Operations Manager OpenPeppol

PARTNERS E-INVOICING EXCHANGE SUMMIT Vienna 2021

Digital Technologies is a young and dynamic company that has more than 70 people in its various locations in Milan, Genoa, Piacenza, Madrid and Shanghai. Our vision is to become the digital intelligence that manages (...)

Doxee is a multinational hi-tech company, listed on AIM Italia and a leading provider of products for Customer Communications Management (CCM), Digital Customer Experience and Dematerialization. (...)

ecosio is a leading provider in the field of B2B integration, specialising in e-invoicing, electronic data interchange (EDI) and supplier relationship management (SRM). Through intelligent technologies and excellent service (...)

EESPA is the European E-Invoicing Service Providers Association. It is an International Not-for-Profit Association (AISBL/IVZW) organised under Belgian law. EESPA acts as a trade association at European level for a large (...)

As a worldwide and state-of-the-art EDI Managed Service Provider, INPOSIA applies its services across all branches and processes. Complex Just-in-Time delivery processes as well as business-critical finance transactions - all business (...)

OpenPeppol is a non-profit international association responsible for the governance and maintenance of the Peppol specifications that enable European businesses to easily deal electronically with any European public sector buyer in their (...)

PwC's Global e-Invoicing and e-Archiving Network brings together process, technology, tax, legal and accounting experts making your E-Invoicing business case reality! For over 15 years now, PwC has been at the forefront of e-Invoicing and (...)

QMS International S.A. is a Joint venture of FoodChain S.p.A. and Triplo M's S.A. The main activity is to promote software/application developed by FoodChain S.p.A. for geographic focus (mainly outside Europe) and/or for project (...)

As the world’s largest provider of enterprise application software, SAP (NYSE: SAP) helps companies of all sizes and industries run better. From back office to boardroom, warehouse to storefront, desktop to mobile device (...)

SEEBURGER AG is a global provider of business integration solutions that streamline business processes, enable digital transformation and business initiatives, reduce operational costs, facilitate governance and compliance (...)

Founded in 2006, SNI currently has over 100 employees, operating across multiple locations in Europe. We offer SAP and Peppol certified solutions (SAF-T, Invoice Reporting, VAT Reporting and e-Invoicing) (...)

Sovos TrustWeaver provides a comprehensive cloud-based compliance service for eInvoicing and other legally critical documents in over 60 countries. Our solution guarantees VAT compliance for hundreds of millions of (...)

Unifiedpost is a leading cloud-based platform for SME business services built on “Documents”, “Identity” and “Payments”. Unifiedpost operates and develops a 100% cloud-based platform for administrative (...)

WhiteDoc was founded in 2006 in the Ukraine and now includes more than 200 high professional employees in CIS. For more than 15 years, we have helped to digitize and synchronize work with data (...)

xSuite is a manufacturer of software applications for document-based processes. We provide organizations across the globe with standardized, digital solutions, making work simple, secure and fast. We focus (...)

Media PARTNERS E-INVOICING EXCHANGE SUMMIT Vienna 2021

CIO Applications Europe has fast culminated into the most sought-after magazine Pan-Europe as it has transformed its course hand-in-hand with the technology and has culminated into a leading media brand, with a unique editorial focus on bringing to light the core innovations in technology.CIO Applications Europe magazine stands out with its unique approach of learning from peers approach offering professionals the most comprehensive collection of technology trends. The magazine is the single most successful initiative Pan-Europe to advise and guide decision-makers regarding the latest in the fast-evolving technology landscape. We are determined to propose a myriad of additional services that can improve businesses and help customers deal with issues related to this industry.

www.cioapplicationseurope.com

EDIZone is an information portal that brings news from the world of digitization of business and logistics processes. It has been in operation since 2004 and it sends to 10,000 subscribers every month.

e3zine.com is a special-interest magazine devoted to SAP software and related topics. It’s a community magazine covering business and technical solutions in today’s SAP marketplace. Our articles add to and expand the information supplied by SAP itself, but it is important to mention that we are completely independent of SAP user groups like DSAG as well as SAP itself. e3zine targets all kinds of users, from IT beginners to computer center supervisors. Lively and accurate journalism gives readers broad knowledge and new insights into SAP solutions and their working environments. Our website has about 35,000 to 40,000 unique visitors a week. The term ‘unique visitors’ means that we exclude any machine-to-machine communication like crawlers or bots – so our figures only indicate real human users who visited our website. Our ad impressions usually hover between 80,000 and 100,000 a week, meaning that visitors like to stay on our website and read multiple articles.

www.e3zine.com

PPN is a not for profit organisation founded in 2008 to form a focal point for the purchase to pay community. Since then it has been successful in providing leading P2P professionals with a sharp insight into the latest news and up-to-date information on key processes and technologies. Today PPN attracts over 14,000 readers to download research, attend insightful webinars, discover how and why other organisations may do things differently, join in with masterclass sessions and attend our annual event. Over the last few years, PPN has established itself firmly at the heart of the P2P business community.

www.p2pnetwork.org

rechnungsaustausch.org - Portal zur Förderung elektronischer Rechnungs- und Geschäftsprozesse - thematisiert die Potenziale eines medienbruchfreien, elektronischen Rechnungsaustauschs sowie den Weg zur Erschließung dieser Potenziale. Das Rechnungsdatenformat ZUGFeRD ist eines der Schwerpunktthemen von rechnungsaustausch.org. Umfassende ZUGFeRD-Anbieter-Übersichten geben dem Anwender Orientierung.

rechnungsaustausch.org

The Paypers is the Netherlands-based leading independent source of news and intelligence for professionals in the global payment community. The Paypers provides a wide range of news and analysis products aimed at keeping the ecommerce, fintech, and payment professionals informed about latest developments in the industry.

www.thepaypers.com

Trade Finance Global (TFG) is the leading trade finance platform. We assist companies to access trade and receivables finance through our relationships with banks, funds and alternative finance houses.

Our award winning educational portal, Trade Finance Talks, serves an audience of 110k+ monthly readers across 186 countries, covering news and insights across print & digital magazines, guides, research papers, podcasts and video.

www.tradefinanceglobal.com