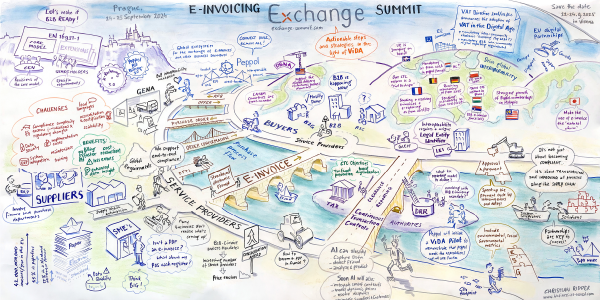

Review E-Invoicing Exchange Summit asia 2022

More than 140 E-Invoicing and E-Reporting experts from 26 countries convened on December 7 and 8, 2022 in Singapore to celebrate the E-Invoicing Exchange Summit Asia. It have been two jam-packed and exciting days full of valuable insights from global experts sharing interesting developments in the world of E-Invoicing for the APAC region and globally.

IMDA (The Infocomm Media Development Authority) took the important role as hosting partner and through their support made this event a great success. They lead Singapore's E-Invoicing story to become a lighthouse for the adoption of E-Invoicing not only in the APAC region. IMDA's Assistant Chief Executive, Der Yao Leong, shared in his keynote how IMDA is building the foundational digital utilities to empower businesses in the digital economy. Seong Wah Geok, Director E-Invoice at IMDA double clicked on how they are pushing for the nationwide adoption of E-Invoicing to enable businesses to invoice each other more seamlessly using Peppol. Especially their InvoiceNow awareness video ("you happy, I happy, eeeeverbody happy!") brought a smile to everyone’s face and is worth watching:

This E-Invoicing Exchange Summit in Singapore once more was a great opportunity to network with new and old friends around the globe and share experiences and latest developments around the introduction and adoption of E-Invoicing, indirect tax reporting and the implementation of continuous transaction controls. To access the presentation slides, click here.

We look very much forward to feature the upcoming developments of E-Invoicing at the next edition of the E-Invoicing Exchange Summit Asia in Singapore on November 28 and 29, 2023.

Agenda of E-INVOICING EXCHANGE SUMMIT Singapore

Pre-Conference Day - DECEMBER 6

18:00 - 21:00

Early Check-In and Icebreaker Reception

Your networking experience starts right here. All participants and speakers are invited to attend the Icebreaker Reception and to pick up their badges.

Conference DaY 1 - DECEMBER 7

09:30 - 09:40

Welcome and Opening

Johannes researches, organizes and runs knowledge and networking platforms that help the industry to benefit from new technologies and cope with changing legal and regulatory frameworks. His events make sure that all stakeholders learn, discuss and network with like-minded experts, practitioners and thought leaders. His main focus lies on E-Invoicing since 1999, carrying out the E-Invoicing Exchange Summits in Europe, Asia and the US, the E-Rechnungs-Gipfel in Germany, and the Swiss Payment Forum in Zurich.

Read more on LinkedIn

Johannes von Mulert Founder and Chairman E-Invoicing Exchange Summit, Switzerland

09:40 - 10:00

Keynote Singapore

Key Ingredients in Building a Digital Economy

Leong Der Yao Assistant Chief Executive, IMDA, Singapore

10:00 - 10:30

Next Bound on Singapore E-Invoicing

After 3 years implementing the Peppol network, Singapore has over 50 000 businesses registered with transactions steadily growing. To take the adoption to the next level, Singapore has embarked on several new initiatives.

+ Making available new government incentives

+ Building eco-system capabilities

+ Creating new value-add on the network

Geok Seong Wah Director E-Invoice, IMDA, Singapore

Watch video message

10:30 - 11:00

Global Developments in Peppol

André Hoddevik Secretary General, OpenPeppol, Belgium

11:30 - 12:00

Wins and Challenges of E-Invoicing Adoption in Australia

Larissa Walker Director E-Invoicing Adoption and Mark Stockwell Director E-Invoicing, Australian Taxation Office, Australia

12:00 - 12:30

E-Invoicing in New Zealand - The Journey so Far

Discussion around the New Zealand Government’s policy approach and how this has been translated into action.

Craig Smith Principal Policy Analyst, eInvoicing and eProcurement, Ministry of Business, Innovation and Employment, New Zealand

12:30 - 12:45

Q&A Session

Reflection and Action on E-Invoicing In Asia-Pacific

moderated by Geok Seong Wah Director E-Invoice Project Office, IMDA, Singapore

Watch video message

14:00 - 14:30

Evolution, Implementation and Procedures of E-Invoicing in India

+ GST mechanisms with E-Invoicing

+ How to fight tax evasion

+ ITC matching and mismatching with E-Invoicing in GST

+ Real time processing of E-Invoice and data for GST compliances

Bimal Jain FCA, FCS, LLB and Chairman of Indirect Tax Committee of PHD Chamber of Commerce, India

14:30 - 15:00

Progress Report: E-Invoicing Initiative in Japan

In July 2022, Japan finally started the accreditation process for Peppol Certified Service Provider and have been attracting global attention.

+ Learn more on the progress: Japan is finalizing “JP PINT”

+ Learn more on the current situation in Japan market

+ Learn more on outlook of e-invoicing initiative beyond the implementation of Peppol e-invoice

Hiroyuki Kato Director, Digital Agency, Government of Japan and Atsuya Sugawara Delegate of Japan Peppol Authority, Japan

15:45 - 16:15

E-Invoicing and Continuous Transaction Controls in the Digital Age

Changes in requirements around E-Invoicing and E-Reporting are happening at lightning speed. Tax administrations globally increasingly use digital tools to get (real-time) insights into taxpayers and their transactions. This transformation of the tax technology landscape is affecting nearly all businesses, and especially those that are active globally. The pace at which new E-Invoicing and E-Reporting obligations are being implemented in many countries is driving the need for an appropriate tax and IT strategy. Having a proactive and centralised approach in place is recommended more than ever.

During this session, you will:

+ Get updates on the upcoming E-Invoicing and E-Reporting mandates and insights in the latest trends in global E-Invoicing and VAT compliance requirements

+ Discuss how to develop your future-proof global e-requirements strategy and what are the building blocks for success

Ellen Cortvriend Director and Brecht van Petegem Manager Indirect Tax Technology, PwC, Belgium

16:15 - 17:00

PANEL DISCUSSION

Upcoming Drivers and Shifts for National E-Invoicing Initiatives in Asia-Pacific: The Value of a Common E-Invoicing Standard

Mohit Mehrotra Monitor Deloitte Leader, SEA

Manjeet Yadav Head of E-Invoicing, Valta Technology Group

Hiroyuki Kato Director, Digital Agency, Government of Japan

moderated by Bill Xiao Assistant Director, E-Invoice Project Office, IMDA Singapore

Watch video message

17:40 - 21:00

Networking Dinner

All participants and speakers are invited to enjoy dinner and refreshments in a casual atmosphere. Use this perfect opportunity to intensify your business contacts and grow your network.

Conference DaY 2 - DECEMBER 08

09:00 - 09:30

An E-Invoice Exchange Framework for the U.S.

+ Learn more on the progress the BPC is making towards developing the exchange framework for the United States

+ Learn who is involved with the market pilot and how E-Invoicing Exchange Summit attendees can participate

+ Lean on what the future holds for the exchange framework beyond the market pilot

Todd Albers Sr. Payments Consultant Payments, Standards and Outreach Group, Federal Reserve Bank of Minneapolis, USA

09:30 - 10:00

Beyond Taxes and E-Invoicing Exchange

In this presentation you will learn more about services offered by LATAM tax administrations to taxpayers, other government agencies and for the society in general using information from E-Invoicing. Businesses, citizens and public administrations receive additional benefits from the sharing of E-Invoicing data, and with this for example governments are able to better control their expenditures, reduce toll fares for unloaded trucks, and citizens will find better times - with less consumers - to go to a particular shop or gas station.

+ Benefits for companies of using information extracted from E-Invoicing

+ Benefits for other government agencies of using information extracted from E-Invoicing

+ Comments on the secrecy of the information gathered along the E-Invoicing process, and how to realize the full potential of interchanging information

Vinicius Pimentel de Freitas CTO, Inter-American Center of Tax Administrations (CIAT), Panama

10:30 - 11:00

Unlocking the Full Potential of E-Invoicing: Now and into the Future

+ Current state: Complex and evolving E-Invoicing market in APAC and beyond

+ Opportunities and challenges the market presents for organisations

+ Keys to success: how to unlock the full potential of E-Invoicing

+ Customer case study

Raymond Lam Managing Director, Pagero ASEAN and Bertrand Gauch Regional Manager, Pagero ANZ

11:00 - 11:30

Update from the EU and Germany: Is Europe Heading Towards a Common Model for Electronic Exchange of Invoices and Tax Related Data?

+ VAT Reporting and E-Invoicing: Current developments in the European Union

+ Where and when will we see the next B2B mandates and what exchange model is leading in the debates?

+ Role of SMEs (situation and special needs)

+ Update B2G: Consolidation of public procurement

+ Status of the current discussions on a B2B obligation and CTCs

Ivo Moszynski Chair of FeRD (German Forum for Electronic Invoicing) and

Richard Luthardt Member of the Board of VeR (German E-Invoicing Association) and Member of the Board of EESPA (European E-Invoicing Service Providers Association) as German Chapter

11:30 - 12:00

Hyperautomation Trends Enhancing Performance in AP Processes

Starting from an overview on Hyperautomation and its value in AP processes, the speech illustrates - through a real case – the potential of self-learning algorithms, based on machine learning (ML) and artificial intelligence (AI), in the automatic reconciliation process of AP documents, such as electronic invoices received from suppliers and PODs. The innovation brought by these technologies allows to enhance efficiency in the overall process, enabling a significant cost and error reduction.

Enrico Liverani Chief Consulting & Key Account Director, Digital Technologies, Italy

13:30 - 14:00

Roundtable Sessions

I. Value Added Services Provided by Tax Authorities Through E-Invoicing Data

Vinicius Pimentel de Freitas CTO, Inter-American Center of Tax Administrations, Panama

II. The 4-Corner Model for E-Invoice Exchange

Ken Holman CTO, Crane Softwrights

III. E-Invoicing in APJ – Challenges and Opportunities

Martin Prinz APJ Head of Globalization Product Management, SAP

IV. Diving Deeper into Latest Developments in Europe

Ivo Moszynski Chair of FeRD (German Forum for Electronic Invoicing) and Richard Luthardt Member of the Board of VeR (German E-Invoicing Association) and Member of the Board of EESPA (European E-Invoicing Service Providers Association) as German Chapter

V. Learn more about the Peppol International Invoice

Georg Birgisson OpenPeppol Expert

14:00 - 14:30

Why Would a Bank be Interested in Becoming a Peppol-Ready Solution Provider?

Park Kwan Hoon Director, Global Transaction Banking, OCBC Bank, Singapore

14:30 - 15:00

OpenPeppol: Decentralised Continuous Transactions and Controls (DCTCE)

Increase your knowledge of CTC and the different approaches around the world; learn how Peppol CTC supports cross-border trade; and hear about our Proof-of-Concept projects.

Lefteris Leontaridis Operations Manager and Steve Graham Market Development Lead, OpenPeppol

15:00 - 15:15

Global Interoperability: Update

The Fundamentals and Current Developments and Challenges of Global Interoperability

The Global Interoperability Framework (GIF) is a set of recommended practices and standards for the operation of any ‘four-corner’ interoperability network organised within a participative governance framework. Such a network allows its dedicated access points, typically service providers, to easily interconnect their customers for the exchange of digital supply chain-related transactions.

As a state-of-the-art reference model, the GIF reflects well-accepted technologies and building blocks and seeks maximum alignment of interoperability frameworks operating in different settings. Following its deployment in the pioneering Peppol network, which has expanded from Europe into other markets in Asia-Pacific, other implementations are taking place in the European service provider community (EESPA) and in the USA within the Business Payments Coalition.

The GIF enables smoother implementation of end-user business connections and will be able to contribute to the rapidly evolving tax-reporting (CTC) environment in many countries. The GIF Working Group promotes and shares best practice seeking to constantly evolve the framework towards the objective of seamless interoperability between compliant networks.

Charles Bryant Secretary GIF Working Group and Industry Advisor

15:15 - 16:00

Global Interoperability: PANEL DISCUSSION

What Should be the Next Steps for Truly Global Interoperability?

This session brings together a panel of thought leaders to discuss how to build on the various successful regional and national initiatives and models for interoperability to create a truly global approach.

+ Managing diversity and commonality - where are the pressure points?

+ What is working consistently and why?

+ How to reconcile different business, fiscal and legal models?

+ Building consensus and an alliance of stakeholders

Vinicius Pimentel de Freitas CTO, Inter-American Center of Tax Administrations, Panama

Geok Seong Wah Director E-Invoice, IMDA, Singapore

André Hoddevik Secretary General, OpenPeppol, Belgium

moderated by Charles Bryant Secretary GIF Working Group and Industry Advisor

Lead Supporter

The Infocomm Media Development Authority (IMDA) is the PEPPOL Authority in Singapore, spearheading the nationwide E-Invoicing initiative. The PEPPOL network in Singapore has gone live on 9 January 2019. Enterprises can connect to the network to gain improved efficiency, reduced cost and faster payment cycles as well as access to new financing options.

Industry Partners

cbs is a global consulting practice that originated in Germany with over 3000 international projects over the last 25 yea rs. We advise the world’s most notable companies: renowned, highly innovative (...)

Digital Technologies is a young and dynamic company that has more than 70 people in its various locations in Milan, Genoa, Piacenza, Madrid and Shanghai. Our vision is to become the digital intelligence that manages (...)

Pagero is the fastest growing global business network, offering cloud-based e-invoice and e-order services. Pagero brings companies together digitally regardless of size, volume, location and ERP system. (...)

OpenPeppol is a non-profit international association responsible for the governance and maintenance of the Peppol specifications that enable European businesses to easily deal electronically with any European public sector buyer in their (...)

PwC's Global e-Invoicing and e-Archiving Network brings together process, technology, tax, legal and accounting experts making your E-Invoicing business case reality! For over 15 years now, PwC has been at the forefront of e-Invoicing (...)

As the world’s largest provider of enterprise application software, SAP (NYSE: SAP) helps companies of all sizes and industries run better. From back office to boardroom, warehouse to storefront, desktop to mobile device (...)

Founded in 2006, SNI currently has over 100 employees, operating across multiple locations in Europe. We offer SAP and Peppol certified solutions (SAF-T, Invoice Reporting, VAT Reporting and e-Invoicing) (...)

At Tickstar, we’re on a journey to help businesses around the world to connect and interact more seamlessly through eDelivery of business documents. Tickstar provides best-of-breed (...)

Media

VATupdate.com collects and publishes VAT-related news from all around the world. The website exists since 2018 and is made by and for VAT-enthusiasts. The website continuously provides updates on VAT regulations, VAT rates, case-law, events, job opportunities, tax technology and tools, and trends and developments (such as VAT e-invoicing requirements).

Besides the core members in the Netherlands and Belgium, the VATupdate Team consists of various independent contributors from all over the world. News items are posted on the website, but also on LinkedIn, Twitter and in the weekly newsletter.

www.vatupdate.com