Review E-Invoicing Exchange Summit Dublin 2023

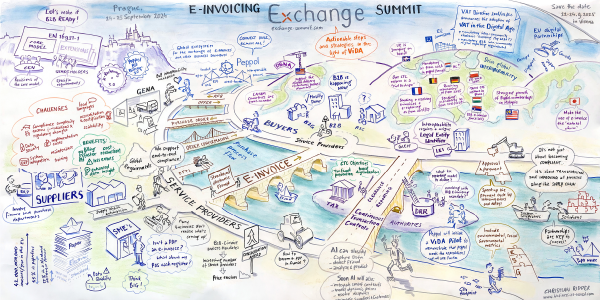

Download Graphic Recording 2023. Copyright Christian Ridder, business-as-visual.com

Almost 300 E-Invoicing experts met in Dublin

With almost 300 participants the E-Invoicing Exchange Summit 2023 in Dublin has been a perfect opportunity to network with all relevant stakeholders in the field. These first days of October have been ideal to learn about the latest news and developments in global E-Invoicing implementations and digital reporting requirements.

3 days fully packed with deep-dive workshops, presentations, panel discussions and roundtables have made Dublin to a hot spot of the E-Invoicing industry. Participants from 31 different countries, from governments, multinational corporates, legal and tax advisory firms, policymakers, industry associations and all major E-Invoicing service providers came together to exchange best practices and develop strategies to cope with upcoming challenges.

Especially ViDA - the VAT in the Digital Age initiative from the European Commission - was pivotal when discussing the way forward for E-Invoicing in Europe over the next 5 years. And for sure, there is a field of tension between tax authorities' needs to quickly close VAT gaps, and the urge for automated and efficient processes on the business side. It became obvious that to be successful and competitive in international trade all parties involved need to align their strategies and find a good balance between transparency and efficiency.

Thanks to the artist Chris Ridder a new “Big Picture of E-Invoicing” has been drawn that reflects the topical highlights of the three conference days, embedded in the great scenery of the networking dinner event. Download the graphic recording for free.

We want to express our thank you to all participants, speakers, partners, and persons involved to make this edition of the E-Invoicing Exchange Summit such a great success.

To access the presentation slides, click here and stay informed with our E-Invoicing News.

WORKSHOP Day - October 2

10:00 - 12:30

Workshop A

Aligning E-Invoicing and DRR Developments under ViDA, with Global and Future-Looking Perspectives

(attendance exclusively reserved for government representatives)

Introduction: State of CTC in the EU and Globally

Nazar Paradivskyy Global Subject-Matter Expert, Leader of OpenPeppol CTC Community and Member of EESPA Public Policy and Compliance Working Group

Insights into Current Work of OECD for Better Aligning Government´s Approaches Globally

+ Design: Aiming to limit compliance burdens for corporates

+ Implementation: business consultation, clarity, facilitation, collaborative design

+ Re-usability of standards and formats: what types of formats and requirements already existing and could be a good basis

Piet Battiau Head Consumption Taxes Unit, Centre for Tax Policy and Administration, OECD, France

Current State of Play in Selected Countries

+ Country-specific presentations by government representatives

+ Poll: What is the current state of play in your country?

Wouter Bollaert Federal Public Service Finance, Belgium

Hans Joachim Narzynski Head of Division VAT International, Federal Ministry of Finance, Germany

Mario Carmelo Piancaldini Services Division, Procedures Sector, Revenue Agency, Italy

Gérard Soisson Coordinator for E-Invoicing, Ministry for Digitalisation, Luxembourg

Rune Kjorlaug The Norwegian Agency for Public and Financial Management (DFO) and on behalf of the Nordic Smart Government and Business Project

Ana Isabel Mascarenhas Head of Tax Audit Department, Portuguese Tax and Customs Authority, Portugal

Elinor Paterson Deputy Director of VAT Infrastructure and Soft Drinks Industry Levy and Jack Warburton Policy Lead for VAT E-Invoicing, HM Revenue & Customs, United Kingdom

Open Discussion

+ Clarifications to country presentations

+ Future vision for CTC developments

+ Localization and additional requirements

Workshop conducted by Nazar Paradivskyy Global Subject-Matter Expert, Leader of OpenPeppol CTC Community and Member of EESPA Public Policy and Compliance Working Group and Piet Battiau Head Consumption Taxes Unit, Centre for Tax Policy and Administration, OECD, France

10:00 - 12:30

Workshop B

What Multinationals Expect From Service Providers – An Interactive Dialogue on the Future of Digitalization

Pain points and needs for global corporates in an unharmonised world of Transactional Tax Reporting and E-Invoicing

A model for visualizing the impact of tax digitization on a typical enterprise system and process landscape

Discussion on how the market can evolve towards future-proof digitization solutions, including but not limited to:

+ Data Consistency Verification Tools

Background: Periodic reporting (SAF-T, monthly VAT pre-announcement) will continue to exist in parallel with real-time reporting for some time - so attention must be paid to consistency, or in the case of deviations, attention must be paid to the justification/reconcilability.

+ Combined tools to create and use the same standardised data sets for Tax Reporting and E-Invoicing

+ Data Extraction Tools from enterprise ERP systems

Example: The future payment status reporting in France and Spain makes SAP FI data extraction necessary.

+ Tools to overcome the challenges of centralised governmental E-Invoicing transmission hubs

Conclusions: How can the market ensure tax digitization becomes a win-win for all stakeholders?

Workshop conducted by Christiaan van der Valk Executive Committee Member and Chair Public Policy & Compliance, EESPA and Digitalization Dialogue, CIAT and Alexander Kollmann User-Group TaxVoice and Head of Transactional Tax-Reporting, Schwarz Dienstleistungs KG (Lidl, Kaufland)

13:30 - 16:30

Workshop C

Requirements and Technical Specification to Extend EN 16931 for B2B E-Invoicing

E-Invoicing based on EN 16931 will be mandatory for VAT Digital Reporting Requirements as per ViDA. A new project funded by the EU has been set-up to define the key deliverables by the end of 2024.

+ Gathering B2B requirements for intra-EU E-Invoicing

+ Specifying new data requirements for Digital Reporting Requirements

+ CEN technical specifications and guidelines on common B2B requirements that are needed to extend the EN 16931

+ How the registry should be updated to store the B2B and B2G variants (sectoral and national)

+ Syntax bindings and validation artefacts

+ What challenges or opportunities this will bring for services offered

- by ERP and Accounting Software providers

- by the Finance/Payments industry

Workshop conducted by Edmund Gray CEO Omni Technology Solutions, Ireland and convener of CEN/TC 434/WG7 and Jostein Frømyr General Manager Edisys Consulting AS, Norway and convener of CEN/TC 434/WG5

13:30 - 16:30

WORKSHOP D

Peppol and Decentralised Continuous Transaction Controls (DCTCE)

+ Balancing the requirements of policy makers and the needs of end users

+ Understanding Peppol in the context of domestic and global eInvoicing and CTC

+ Applying a Peppol approach to ViDA intra-EU and domestic requirements

+ Participate in Q&A with an expert panel of policymakers and end users

Workshop conducted by Nazar Paradivskyy Global Subject-Matter Expert, Leader of OpenPeppol CTC Community and Member of EESPA Public Policy and Compliance Working Group, Piet Battiau Head Consumption Taxes Unit, Centre for Tax Policy and Administration, OECD, France, Liz Gallagher Indirect Tax Director, Meta, Ireland and Steve Graham Market Development Lead, OpenPeppol, Belgium

16:30 - 20:00

Icebreaker Reception supported by Avalara

Your networking experience starts right here. All participants and speakers are invited to attend the Icebreaker Reception and to pick up their badges for the two conference days.

Conference DaY 1 - October 3

09:00 - 09:15

Welcome and Opening

Johannes researches, organizes and runs knowledge and networking platforms that help the industry to benefit from new technologies and cope with changing legal and regulatory frameworks. His events make sure that all stakeholders learn, discuss and network with like-minded experts, practitioners and thought leaders. His main focus lies on E-Invoicing since 1999, carrying out the E-Invoicing Exchange Summits in Europe, Asia and the US, the E-Rechnungs-Gipfel in Germany, and the Swiss Payment Forum in Zurich.

Read more on LinkedIn

Johannes von Mulert Founder and Chairman E-Invoicing Exchange Summit, Switzerland

09:15 - 09:45

THE VOICE OF THE INDUSTRY

The Major Industry Trends, Challenges and Opportunities

+ ViDA and the future wave of mandates: How to be prepared?

+ EESPA becoming GENA: What is the purpose?

+ EESPA-Peppol Incubation project: A breakthrough initiative?

Bengt Nilsson Co-Chair, EESPA

Marcus Laube Co-Chair, EESPA

Michel Gilis Chair, EESPA Interoperability Working Group

Moderated by: Christiaan van der Valk Chair, EESPA’s Public Policy & Compliance Working Group

09:45 - 10:15

The Commission Proposal on VAT in the Digital Age – State of Play

Ludwig De Winter Deputy Head of Unit, DG Taxation and Customs Union (DG TAXUD), European Commission, Belgium

10:15 - 10:45

Global E-Invoicing Becomes a Reality

+ Peppol - launching the International Invoice

+ Peppol - an enabler for business efficiency

+ Peppol - an enabler for tax administration

+ Peppol - increasing adoption by governments and businesses

André Hoddevik Secretary General, OpenPeppol, Belgium

11:15 - 11:45

Recent Study Results: Challenges and New Use Cases for E-Invoicing

Results of the studies conducted for the European Commission that will serve for future policy orientations will be shared for the first time:

+ Conclusions and recommendations to address E-Invoicing challenges identified in the EU

+ Use of emerging technologies for E-Invoicing

+ Effects of the Directive on E-Invoicing in public procurement

Carmen Ciciriello Lead Advisor E-Invoicing, DG GROW, European Commission

11:45 - 12:15

The Impact of E-Invoicing and E-Reporting on Tax and Business as Usual Processes

Tax authorities are driving the need for businesses to adopt E-Invoicing across the globe. As tax becomes an integral part of day-to-day finance and commercial operations, this session will explore the key changes, trends, opportunities and challenges to businesses and their stakeholders. Alex from Avalara will provide insights in relation to the major changes across people, process and data. He will bring some of these issues to life by looking at recent or upcoming mandates as case studies, including a demonstration of the new KSeF E-Invoicing platform in Poland.

+ Increased visibility of taxpayer and tax due to live sharing granular data

+ Real time validation and checks leading to increased importance of correct VAT calculation at time of issue of invoice

+ Alignment of business process with tax reporting processes

+ Shift from ERP Tax Codes to Tax category and VATEx codes

+ Impact to Accounts Payable processes – how to receive from vendors?

+ Impact to Accounts Receivable processes – how to send and share with customers?

+ Impact to business stakeholders – is your E-Invoice human readable for key stakeholders?

+ Tax and compliance process benefits resulting from E-Invoicing and E-Reporting including pre-populated VAT returns, incentives and digital archiving

Alex Baulf Senior Director, Product Leader, E-Invoicing, Avalara, United Kingdom

Preparing for E-Invoicing from a Finance, IT, and Tax Perspective

This presentation will emphasize the need for companies to think broadly and strategically about these changes to avoid potential disruptions and maintain good relationships with suppliers and customers. It will highlight the challenges of transitioning to E-Invoicing and the country-specific approach that businesses will need to take. It will address uncertainty prevalent regarding E-Invoicing regulations and the importance of implementing solutions, discuss the risks associated with E-Invoicing in different jurisdictions and the need for businesses to be aware of potential failures. Lastly, it will touch upon the role of third-party vendors and the time-consuming nature of implementing E-Invoicing solutions on a country-by-country basis.

+ Embrace E-Invoicing changes strategically to ensure smooth operations and strong relationships

+ Seek country-specific solutions and expert guidance for successful E-Invoicing implementation

+ Acknowledge the time-consuming nature of implementing country-specific E-Invoicing solutions

+ Overcome challenges in complicated jurisdictions for successful E-Invoicing adoption by collaborating with third-party vendors to navigate the complexities

Gunjan Tripathi EMEA Director of Solutions Marketing, Vertex

Requirements and Technical Specification to Extend EN 16931 for B2B E-Invoicing

This session gives an update on the latest actions and foreseen developments to ensure that EN 16931 becomes even more relevant for B2B E-Invoicing in the European market.

Edmund Gray CEO Omni Technology Solutions, Ireland and convener of CEN/TC 434/WG7 and

Jostein Frømyr General Manager Edisys Consulting AS, Norway and convener of CEN/TC 434/WG5

Germany: B2B Mandate “Ante Portas”

Ivo Moszynski Chair of FeRD (German Forum for Electronic Invoicing) and

Richard Luthardt Member of the Board of VeR (German E-Invoicing Association) and

Hans Joachim Narzynski Head of Division VAT International, Federal Ministry of Finance, Germany

The Data-Driven Tax Technology: How to Manage Big Data Together With E-Reporting Framework?

+ Integration with mandated documents with business processes ( AP Automation etc. )

+ Reconciliation

+ How tax departments can effectively use AI?

Ridvan Yigit Founder & CEO, RTC, Turkey

14:55 - 15:25

Roundtable Sessions

1. How to Become a Dematerialisation Operator in France

Lucien Gimenez Trainer and Expert in Audit and E-Invoicing, France and

Aniela Martin Project Manager B2B Integration/ Payment Services, Markant, Switzerland

2. The 4-Corner Model for E-Invoice Exchange and what it is about

Ken Holman CTO, Crane Softwrights

Watch video message

3. ESG Reporting Requirements in the Digital Supply Chain

Mimi Stansbury Senior Vice President of Finance & Administration, OFS Portal, USA

4. The New Digital Requirements and Functionalities of the Danish Bookkeeping Act (and what they mean for your company)

Jakob Stenfalk Special Advisor, Danish Business Authority, Denmark

5. The Future of E-Invoicing Using Generative AI

Lianne Bowker Senior Indirect Tax Solutions Consultant, Thomson Reuters, United Kingdom

Watch video message

6. Strategies and Approaches to Efficiently Manage Ever-Increasing Legal Requirements Worldwide

Olivia Vorstheim Chief Product Owner – SAP Document and Reporting Compliance, SAP

7. Q&A on Planned E-Invoicing Mandate for B2B in Germany

Ivo Moszynski Chair of FeRD (German Forum for Electronic Invoicing) and

Richard Luthardt Member of the Board of VeR (German E-Invoicing Association) and

Hans Joachim Narzynski Head of Division VAT International, Federal Ministry of Finance, Germany

8. Q&A on E-Invoicing in France

Cyrille Sautereau President and Vincent Barbey Vice President, National Forum for Electronic Invoicing and Electronic Public Procurement (FNFE-MPE), France

More Roundtable Sessions to be added.

Change Management Strategies for Adopting E-Invoicing Effectively at Scale

Lianne Bowker Senior Indirect Tax Solutions Consultant, Thomson Reuters, United Kingdom

Watch video message

Update on Global Regulatory Compliance and Legal Frameworks for B2B, B2G and B2C

Ellen Cortvriend Partner, Global E-Invoicing and E-Reporting CoE Lead, PwC Belgium and

Johnny Wickham Partner Tax Technology & Transformation Lead, PwC Ireland

Corporate Panel

Impulse: Driving E-Invoicing Adoption by Making the Functionality "Mandatory by Design" in Bookkeeping Systems

Jakob Stenfalk Special Advisor, Danish Business Authority, Denmark

Discussion: Maximising Efficiency Potentials for Businesses under ViDA E-Invoicing

+ Is there a need to regulate a delivery network?

+ Can we expect a PEPPOL connectivity from billing software providers?

+ Will the access point providers handle the transactional tax reporting for corporates?

+ How to deal with industry - or even business partner - specific fields in the CEN norm?

+ How to deal with other structured E-Invoicing formats that are not listed in the CEN syntax list, e. g. EDIFACT

Lina Staugaite Tax Technology Manager, MAN Energy Solutions, Switzerland

Oliver Sachtleben Head of Indirect Corporate Taxes, Deutsche Lufthansa AG, Germany

Annette Selter Taxes and Fiscal Policy Officer, The Federation of German Industries (BDI), Germany

Florian Wiebecke Head of Group Tax, Brückner Group SE, Germany

Georg Geberth Director Global Tax Policy, Siemens and Chairman, Institute for Digitalization in Tax Law (IDSt), Germany

Moderated by: Alexander Kollmann User-Group TaxVoice and Head of Transactional Tax-Reporting, Schwarz Dienstleistungs KG (Lidl, Kaufland)

The Merging of Tax Controls: From Periodic Reporting to CTC

+ How CTCs are reshaping tax controls globally

+ How tax authorities are turning the tables using business data

+ Impact for taxpayers: great news with great data, high risks if it’s poor.

+ A closer look at the potential of pre-filled tax returns and how to avoid bad data

Filippa Jornstedt Director, Global Regulatory Analysis and Design, Sovos

Platform Economy’s Evolution: Navigating E-Invoicing Challenges for Digital Success

Join us as we explore the evolving platform economy’s effects on E-Invoicing and unveil pragmatic solutions to tackle obstacles head-on. Discover expert insights into optimizing digital invoicing strategies for a competitive edge in the contemporary business landscape.

Trent Targa Senior Tax Technology Manager E-Invoicing, Fonoa Technologies and

Selin Adler Ring Tax Technology Manager E-Invoicing, Fonoa Technologies

18:00 - 22:30

Networking Dinner supported by Thomson Reuters

All participants and speakers are invited to enjoy dinner and refreshments in a casual atmosphere. Use this perfect opportunity to intensify your business contacts and grow your network.

Conference DaY 2 - October 4

SME Panel

How to Promote Adoption of E-Invoicing Amongst SMEs

There are around 23.1 million small and medium-sized enterprises (SMEs) in the European Union, employing approximately 84.6 million people and having a combined value added of 3.9 trillion EUR. Nearly all these SMEs will be affected by ViDA. But will ViDA make intra-EU trade easier for them?

Tom Van Gaever CEO, Billit, Belgium

Tomi Rusi Realtime Economy Specialist, State Treasury, Finland

Stefan Moritz Secretary General, European Entrepreneurs CEA-PME, Belgium

Moderated by: Aleksandra Bal Indirect Tax Technology & Operations Lead, Stripe, The Netherlands

Invoice Trading: The Other Face of E-Invoicing

Enrico Liverani Chief Consulting & Key Account Director, Digital Technologies, Italy

Finland: How to Achieve 90% B2B E-Invoicing in a Realtime Economy

Tomi Rusi Realtime Economy Specialist, State Treasury of Finland

How a €4.5bn Global Cyber Security Specialist Tackled E-Invoicing

With local finance teams across 40 countries, global cyber security specialist Exclusive Networks implemented one solution to manage their global einvoicing needs. Join James in this session who worked closely with Exclusive Networks in delivering this huge project, and gain valuable insights including:

+ Introducing E-Invoicing and legislation that will impact your business

+ From Local to Global: How Exclusive Networks introduced AP Automation and global E-Invoicing in one solution

+ Implementation: Plan vs reality

+ Measuring value on a local scale

+ Advice for business leaders starting their E-Invoicing journey

James Kearns Head of Commercial, Kefron, Ireland

10:10 - 10:40

The Link With Tax Reporting

E-Invoicing comes with CTC and automated tax returns. We will discuss the challenges around data reconciliation with your ERP, automated tax treatment and associated risks. We will touch base on existing real-time CTC to learn from these experiences.

Pedro Pestana da Silva CEO, Marosa, Spain

How Can Governments Ensure a Successful CTC Program?

With the introduction of CTC mandates across Europe and globally gaining momentum, it is crucial for Governments and Tax Administrations to embrace the lessons learned from existing implementations, combine them with the latest (technological) developments and ensure that their implementation plan is future-proof.

Don’t miss out on this practical session with valuable insights and key the elements you must consider, prioritise and even avoid as you embark on your CTC journey.

Nazar Paradivskyy VP Regulatory Affairs, Pagero, Sweden

The Cost of Wrong Invoices

Although we do not intend to issue incorrect invoices, mistakes sometimes creep in. This session will explain based on real-life examples:

+ What are the consequences of incorrect invoices?

+ What makes an invoice not compliant?

+ When and how do you need to correct an invoice?

Aleksandra Bal Indirect Tax Technology & Operations Lead, Stripe, The Netherlands

Watch video message

PANEL DISCUSSION

Internationalisation of E-Invoicing

With a need to minimise tax losses, policy makers around the world are increasingly driving the adoption of E-Invoicing. Moderated by Steve Graham from OpenPeppol, the panel will discuss the implications for end users and service providers.

Piet Battiau Head of Consumption Taxes, OECD, France

Hiroyuki Kato Director, Digital Agency of Japan

Seong Wah Geok Director, IMDA, Singapore

Chris Welsh CEO, OFS Portal and Chairman of the Board, DBN Alliance, USA

Irena Riviere-Osipov Team Leader for EU E-Invoicing Policy, European Commission

Moderated by: Steve Graham Market Development Lead, OpenPeppol, Belgium

How E-Invoicing Regulation is Impacting Finance Automation from Purchase-to-Pay to Order-to-Cash

+ The State of financial processes, from P2P to O2C

+ How E-Invoicing challenges the established ways of operating a finance department

+ The 5 tips for businesses to accelerate their digital transformation through E-Invoicing

+ The benefits of E-Invoicing for Finance Automation

Valérie Colin VP Global Product Marketing, Finance & Document Automation, Quadient

13:45 - 14:15

Progress Report: E-Invoicing in Japan

In July 2023 Japan succeeded in formal publication of e-invoice specifications based on PINT (Peppol International model for billing). This session will cover all key aspects of the Japanese efforts in the e-invoice initiative to improve efficiencies of businesses, with a particular focus on the current situation and future plan of Japan.

Hiroyuki Kato Director, Digital Agency, Government of Japan and

Atsuya Sugawara Delegate of Japan Peppol Authority, Japan

Watch video message

14:15 - 14:45

USA: The Exchange Framework of The Digital Business Networks Alliance (DBNA) is Up and Running

Chris Welsh Chairman of the Board, DBN Alliance, USA

14:45 - 15:15

PANEL DISCUSSION

The Common European Model for Electronic Exchange of Invoices and Tax Related Data “DCTCE” in the Light of ViDA: Is It a Match or Not?

Nazar Paradivskyy Global Subject-Matter Expert, Leader of OpenPeppol CTC Community and Member of EESPA Public Policy and Compliance Working Group, Sweden

Christiaan van der Valk Executive Committee Member and Chair Public Policy & Compliance, EESPA and Digitalization Dialogue, CIAT

Alexander Kollmann User-Group TaxVoice and Head of Transactional Tax-Reporting, Schwarz Dienstleistungs KG (Lidl, Kaufland), Germany

Cyrille Sautereau President FNFE-MPE, France

Wouter Bollaert Advisor, Federal Public Service Finance (Belgian Tax Authority), Belgium

Industry Partners

Avalara empowers organizations of all sizes and numerous business sectors to automate work in their finance departments, boost efficiency of their administrative operations, and achieve compliancy (...)

Basware is the only procure-to-pay and e-invoicing solution provider that empowers businesses with 100% spend visibility through 100% supplier connectivity and 100% data capture. Our cloud-based technology (...)

Billit stands as a prominent, globally accessible e-invoicing platform with high availability. It has been carefully crafted to simplify electronic invoicing for businesses, streamlining the entire process and surpassing (...)

Comarch is a global provider of advanced, software-defined technologies that help companies from all industries optimize their key business processes. The company’s vast portfolio includes systems and services for efficient data (...)

Digital Technologies is a young and dynamic company that has more than 70 people in its various locations in Milan, Genoa, Piacenza, Madrid and Shanghai. Our vision is to become the digital intelligence (...)

Dynatos is a leading expert, delivering Source-to-Pay and e-Invoicing solutions driving transformation of the finance and procurement function into a digital operation and internal business partner. (...)

Edicom is a global leader in E-Invoicing, EDI, and VAT compliance solutions. With nearly twenty-five years of experience, over 15,000 clients, and projects in 80 countries Edicom can manage any B2B or B2G communications project. (...)

EDITEL is an internationally leading provider of EDI solutions (Electronic Data Interchange) that specializes in the optimization of B2B supply chain processes. The company serves clients in many different business sectors and industries. (...)

Fonoa is an API-first tax technology company that helps businesses automate taxes across the globe. Our modular product suite helps businesses reduce manual workload, increase compliance (...)

GENA stands as an international trade association, embodying a vibrant and expansive community of Service Providers originating from various sectors, including network services, business outsourcing, financial services, (...)

Kefron AP is a specialist Accounts Payable invoice automation SaaS solution developed by Kefron to assist businesses with the management of supplier invoices to improve visibility, control and efficiency. (...)

Marosa helps businesses grow across Europe by providing tech-enabled services, SaaS solutions, and VAT consulting for pan-European VAT compliance. With over 20 years of tax experience, a team (...)

OpenText, The Information Company, helps organizations tackle the most complex digital transformation programs with confidence. With the world’s most complete and integrated Information Management platform we empower (...)

Pagero is the fastest growing global business network, offering cloud-based e-invoice and e-order services. Pagero brings companies together digitally regardless of size, volume, location and ERP system. (...)

OpenPeppol is a non-profit international association responsible for the governance and maintenance of the Peppol specifications that enable European businesses to easily deal electronically with any European public sector buyer in their (...)

PwC's Global e-Invoicing and e-Archiving Network brings together process, technology, tax, legal and accounting experts making your e-Invoicing business case reality! For over 15 years now, PwC has been at the forefront of e-Invoicing and (...)

Quadient is the driving force behind the world’s most meaningful customer experiences. By focusing on Intelligent Communication Automation, Parcel Locker Solutions and Mail-Related Solutions, Quadient helps hundreds (...)

RTC–Designed for Clearance has been founded with a singular vision: to craft a streamlined platform that allows multinational companies to seamlessly manage their compliance needs. RTC Suite; our cloud-based platform built (...)

As the world’s largest provider of enterprise application software, SAP (NYSE: SAP) helps companies of all sizes and industries run better. From back office to boardroom, warehouse to storefront, desktop to mobile device (...)

Sovos TrustWeaver provides a comprehensive cloud-based compliance service for eInvoicing and other legally critical documents in over 60 countries. Our solution guarantees VAT compliance for hundreds of millions of (...)

TESISQUARE® - founded by Giuseppe Pacotto in Bra (CN) in 1995, TESISQUARE is the leading partner for the creation of digital supply chain ecosystems, designed to optimise performance in extensive and complex business networks, guaranteeing operational excellence along the entire value chain (...)

No matter what size organisation, whether you are focused on domestic VAT calculations and returns, or managing compliance across multiple jurisdictions, Thomson Reuters ONESOURCE indirect tax technology simplifies solving global, tax challenges. With Thomson Reuters, corporations can manage tax calculations and returns (...)

Vertex, Inc. is a leading global provider of indirect tax software and solutions. The company’s mission is to deliver the most trusted tax technology enabling global businesses to transact, comply and grow with confidence (...)

Media

EDIZone is an information portal that brings news from the world of digitization of business and logistics processes. It has been in operation since 2004 and it sends to 10,000 subscribers every month.

www.edizone.cz

PPN is a not for profit organisation founded in 2008 to form a focal point for the purchase to pay community. Since then it has been successful in providing leading P2P professionals with a sharp insight into the latest news and up-to-date information on key processes and technologies. Today PPN attracts over 14,000 readers to download research, attend insightful webinars, discover how and why other organisations may do things differently, join in with masterclass sessions and attend our annual event. Over the last few years, PPN has established itself firmly at the heart of the P2P business community.

www.p2pnetwork.org

rechnungsaustausch.org - Portal zur Förderung elektronischer Rechnungs- und Geschäftsprozesse - thematisiert die Potenziale eines medienbruchfreien, elektronischen Rechnungsaustauschs sowie den Weg zur Erschließung dieser Potenziale. Das Rechnungsdatenformat ZUGFeRD ist eines der Schwerpunktthemen von rechnungsaustausch.org. Umfassende ZUGFeRD-Anbieter-Übersichten geben dem Anwender Orientierung.

rechnungsaustausch.org

VATupdate.com collects and publishes VAT-related news from all around the world. The website exists since 2018 and is made by and for VAT-enthusiasts. The website continuously provides updates on VAT regulations, VAT rates, case-law, events, job opportunities, tax technology and tools, and trends and developments (such as VAT e-invoicing requirements).

Besides the core members in the Netherlands and Belgium, the VATupdate Team consists of various independent contributors from all over the world. News items are posted on the website, but also on LinkedIn, Twitter and in the weekly newsletter.

www.vatupdate.com