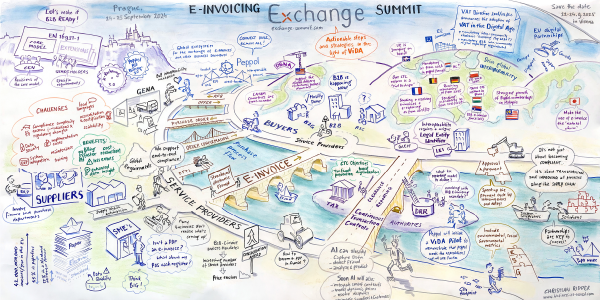

Review E-INVOICING EXCHANGE SUMMIT in Singapore 2023

E-Invoicing Developing Rapidly in Asia Pacific

A total of 160 experts from 25 countries convened at the APAC edition of the E-Invoicing Exchange Summit in Singapore from December 4 to 6, 2023. The growing interest in E-Invoicing and Tax Reporting in the region was evident, even during the pre-conference workshop where almost 100 participants attended the session on 'Continuous Transaction Controls and Peppol International Invoice (PINT),' conducted by OpenPeppol.

Over the subsequent two conference days, significant developments in Singapore and Malaysia took center stage, featuring presentations from IMDA and MDEC. The focus on the Asia Pacific region was further enriched with updates from Japan, New Zealand, and Australia, along with a high-level panel discussion involving government representatives. Additionally, a selection of noteworthy global developments was presented, including the latest status of the exchange framework driven by the Digital Business Networks Alliance in the US and anticipated mandates for the GCC region.

The impressive program concluded with strategic advice on managing the impact of global E-Invoicing and E-Reporting regulations on business processes. Participants learned how to navigate the ever-changing landscape to stay compliant and, crucially, how to build a truly international and interoperable E-Invoicing and E-Reporting mechanism for success.

We extend our gratitude to all participants, speakers, and partners who contributed to making this edition of the E-Invoicing Exchange Summit a resounding success.

To access the presentation slides, click here and stay informed with our E-Invoicing News.

To relive the fantastic dinner event and the outstanding live performance of the “E-Invoicing Song”, click here.

E-INVOICING EXCHANGE SUMMIT in Singapore - December 4 to 6, 2023

Workshop day - December 4

10:00 - 12:15

Workshop Part 1

Peppol and Continuous Transaction Controls (CTC)

+ Balancing the requirements of policy makers and the needs of end users

+ Understanding Peppol in the context of domestic and global eInvoicing and CTC

+ Hear about the Singapore approach to leverage Peppol for Tax Administration

+ Hear how Peppol e-Invoicing can support tax implementation in Malaysia

+ Participate in our live poll questions and see the results during the workshop

+ Participate in a Q&A session with the speakers

Seong Wah Geok Director, IMDA, Singapore

Saiful Izwan bin Mohd Shazali Director, MDEC, Malaysia

Workshop conducted by Steve Graham Market Development Lead, OpenPeppol, Belgium

13:15 - 16:00

Workshop Part 2

Global Interoperability and the Peppol International Invoice

+ Global interoperability supporting international trade

+ Understanding the Peppol International Invoice

+ Hear about progress in Japan in adopting the Peppol International Invoice

+ Hear how Singapore, Australia, and New Zealand will transition to the Peppol International Invoice

+ Participate in our live poll questions and see the results during the workshop

+ Participate in a Q&A session with the speakers

Georg Birgisson E-Invoicing and OpenPeppol Expert, Iceland

Hiroyuki Kato Director, Digital Agency of Japan

Craig Smith Director eInvoicing, Ministry of Business Innovation and Employment, New Zealand

Casey Tan Tech Lead, IMDA, Singapore

Workshop conducted by Steve Graham Market Development Lead, OpenPeppol, Belgium

16:00 - 19:00

ICEBREAKER RECEPTION supported by sni

Your networking experience starts right here. All participants and speakers are invited to attend the Icebreaker Reception and to pick up their badges for the two conference days.

Conference DaY 1 - DECEMBER 5

09:30 - 09:40

Welcome and Opening

Johannes researches, organizes and runs knowledge and networking platforms that help the industry to benefit from new technologies and cope with changing legal and regulatory frameworks. His events make sure that all stakeholders learn, discuss and network with like-minded experts, practitioners and thought leaders. His main focus lies on E-Invoicing since 1999, carrying out the E-Invoicing Exchange Summits in Europe, Asia and the US, the E-Rechnungs-Gipfel in Germany, and the Swiss Payment Forum in Zurich.

Read more on LinkedIn

Johannes von Mulert Founder and Chairman E-Invoicing Exchange Summit, Switzerland

09:40 - 10:00

Keynote

Architecting Singapore’s Digital Economy

Kiren Kumar Deputy Chief Executive, IMDA, Singapore

10:00 - 10:30

How Singapore Is Pushing The Envelope for E-Invoicing

Seong Wah Geok Director E-Invoice and

Bill Xiao Deputy Director, E-Invoicing Project Office, IMDA, Singapore

Watch video message

10:30 - 11:00

Global E-Invoicing Becomes a Reality

+ Peppol - launching the International Invoice

+ Peppol - an enabler for business efficiency

+ Peppol - an enabler for tax administration

+ Peppol - increasing adoption by governments and businesses

André Hoddevik Secretary General, OpenPeppol, Belgium

11:30 - 12:00

E-Invoicing for B2B in Malaysia

Saiful Izwan Mohd Shazali Director, National e-Invoicing & Standardisation, Digital Trade, MDEC, Malaysia

12:00 - 12:30

E-Invoicing: The Importance of Strategy Setting Now and Key Technology Considerations

Pierre Arman Partner, Global Indirect Tax SaaS Go-to-Market, EY Consulting LLC, UAE

13:30 - 14:00

Country Update from Australia

Mark Stockwell Director eInvoicing, Australian Taxation Office, Australia

14:00 - 14:30

A Bias for Action – Accelerating the E-Invoicing Adoption Journey in New Zealand

In this discussion, Michael will talk about the focus and bias for action that he and the New Zealand E-Invoicing team have been taking over the last 12 months. This has seen the Government CFO community and the CFO’s of a number of large private sector businesses get re-energised over E-Invoicing adoption with a focus on secure transactions, data standardisation and how this can contribute to a more productive and digital economy.

Michael Alp Chief Operating Officer, Ministry of Business, Innovation and Employment, New Zealand

14:30 - 15:00

E-Invoicing Success: Navigating Mutual Benefits for Taxpayers and Tax Authorities

+ Existing E-Invoicing models impact on the success journey for TAs & MNEs.

+ Enhanced Models to streamline E-Invoicing benefits: Spain Case & France Case

+ Common elements of stressing all E-Invoicing models to add value to TAs and MNEs

+ Closer look to ASIA E-Invoicing models and how TAs and MNEs are taking advantage of them

Fritz Hu Global Account Manager and André Menezes Global Sales Manager, Edicom, Spain

15:30 - 16:00

Keynote

The Future of EU E-Invoicing in the World

Maive Rute DG GROW Deputy Director-General and Chief Standardisation Officer, European Commission, Belgium

16:00 - 16:30

Update on Global Regulatory Compliance and Legal Frameworks for B2B, B2G and B2C

Ellen Cortvriend Partner, Global E-Invoicing and E-Reporting CoE Lead and

Christoph Zenner Partner Global ITX Network Lead, PwC, Belgium

16:30 - 17:15

PANEL DISCUSSION

Driving Digitalisation Across APAC with Peppol

Craig Smith Director eInvoicing, Ministry of Business Innovation and Employment, New Zealand

Seong Wah Geok Director, E-Invoicing Project Office, IMDA, Singapore

Hiroyuki Kato Director, Digital Agency, Government of Japan

Mark Stockwell Director eInvoicing, Australian Taxation Office, Australia

Saiful Izwan Mohd Shazali Director, National e-Invoicing & Standardisation, Digital Trade, MDEC, Malaysia

Moderated by Robert Tay Former Peppol MC-member, Singapore

18:00 - 22:00

Networking Dinner supported by Thomson Reuters

All participants and speakers are invited to enjoy dinner and refreshments in a casual atmosphere. Use this perfect opportunity to intensify your business contacts and grow your network.

Conference DaY 2 - DECEMBER 6

09:00 - 09:30

Update on the Fast Developing E-Invoicing and Digital Reporting Landscape in GCC Countries

+ Current state of E-Invoicing introduction in the GCC

+ Clearance model implementation by the GCC tax authorities

+ Practical challenges for tax authorities and businesses in implementing and complying with the Clearance model for E-Invoicing

+ Impact of the new E-Invoicing mandates on business operations and long standing practices.

Mehrdad Talaifar Digital Tax Technology Strategy and Operational Tax Transformation Executive, UAE

09:30 - 10:00

Progress Report: E-Invoicing in Japan

In July 2023 Japan succeeded in formal publication of e-invoice specifications based on PINT (Peppol International model for billing). This session will cover all key aspects of the Japanese efforts in the e-invoice initiative to improve efficiencies of businesses, with a particular focus on the current situation and future plan of Japan.

Hiroyuki Kato Director, Digital Agency, Government of Japan and

Atsuya Sugawara Delegate of Japan Peppol Authority, Japan

Watch video message

10:30 - 11:00

Facilitating Global Interoperability and Compliance: Meet GENA

Marcus Laube Co-Chairman, Richard Luthardt Board Member German Chapter, Michel Gilis Head of Interoperability Working Group, GENA - Global Exchange Network Association

11:00 - 11:30

USA: The Exchange Framework of The Digital Business Networks Alliance (DBNA) is Up and Running

Dolf Kars and Alex Baulf Board of Directors, DBN Alliance, USA

11:30 - 12:00

The Increasing Impact of E-Invoicing and E-Reporting on Tax and Business as Usual Processes in Asia-Pacific

Governments and tax authorities are driving the need for businesses to adopt E-Invoicing across the globe. As more countries across the Asia-Pacific region mandate E-Invoicing, tax becomes an integral part of day-to-day finance and commercial operations, this session will explore the key changes, trends, opportunities and challenges to businesses and their stakeholders. Alex from Avalara will provide insights in relation to the major changes across people, process and data. Alex will bring some of these issues to life be looking at recent or upcoming mandates as case studies, including looking at Japan, Singapore and Malaysia. The session will include:

+ Increased visibility of taxpayer and tax due to live sharing granular data

+ Real time validation and checks leading to increased importance of correct VAT calculation at time of issue of invoice

+ Alignment of business process with tax reporting processes

+ Shift from ERP Tax Codes to Tax category and VATEx codes

+ Impact to Accounts Payable processes – how to receive from vendors?

+ Impact to Accounts Receivable processes – how to send and share with customers?

+ Impact to business stakeholders – is your E-Invoice human readable for key stakeholders?

+ Tax and compliance process benefits resulting from E-Invoicing and E-Reporting including increased automation of GST returns, incentives and digital archiving

Alex Baulf Senior Director, E-Invoicing, Avalara, UK

13:00 - 13:45

Roundtable Sessions

Discuss the most pressing business-relevant topics with your peers and gain valueable information.

1. E-Invoicing and Tax Reporting with SAP

Mervyn Ichsan Senior Product Manager, SAP, Singapore

2. Latest Update from Germany

Richard Luthardt Board Member, E-Invoicing Alliance, Germany

3. Global Interoperability

Michel Gilis Head of Interoperability Working Group, GENA - Global Exchange Network Association

4. Crowdsourcing Knowledge on How CTC Impacts Commercial Charging Models for E-Invoicing

As more countries are looking into implementing CTC, how would service providers tweak their charging model to help businesses in tax compliance and at the same time encourage B2B E-Invoicing. Targeted at market players who have good experience in this space as well as those who have good ideas.

Siraj Iqbal Assistant Director, E-Invoicing Project Office, IMDA, Singapore

5. E-Invoicing As An Enabler of Data-Driven Financing Services - What Can be Achieved With the Peppol E-Invoicing Network?

As more countries and enterprises join Peppol and drive E-Invoicing adoption, how can businesses derive greater value and benefits using the network? What opportunities and challenges does this unlock for service providers and regulators?

Sharath Singh Commercial Director, SESAMi, Singapore

6. Key Practical Steps In Getting Ready for E-Invoicing: From Impact Assesment to Go-Live

Pierre Arman Partner, Global Indirect Tax SaaS Go-to-Market, EY Consulting LLC, UAE

13:45 - 14:15

Order and Invoice Response to Boost Adoption in Singapore

Siraj Iqbal Assistant Director, E-Invoicing Project Office, IMDA

Watch video message

14:45 - 15:15

User Adoption - What Do The End Users Have To Say

More than 95% of businesses are SMEs. Why do they join an E-Invoicing network? What is the process for them? Hear real feedback from the end user community on their view of E-Invoicing, including case studies and statistics from enterprise businesses and government departments that interact with them.

Robin Sands CEO, Link4, Australia

15:15 - 15:45

Internationalisation of E-Invoicing

With a need to minimise tax losses, policy makers around the world are increasingly driving the adoption of E-Invoicing.

Steve Graham Market Development Lead, OpenPeppol, Belgium

Industry Partners

Avalara empowers organizations of all sizes and numerous business sectors to automate work in their finance departments, boost efficiency of their administrative operations, and achieve compliancy (...)

Digital Technologies is a young and dynamic company that has more than 70 people in its various locations in Milan, Genoa, Piacenza, Madrid and Shanghai. Our vision is to become the digital intelligence that manages (...)

Edicom is a global leader in E-Invoicing, EDI, and VAT compliance solutions. With nearly twenty-five years of experience, over 15,000 clients, and projects in 80 countries Edicom can manage any B2B or B2G communications project. (...)

EY provides Global Tax E-invoicing Tool (GTES) to help solve clients tax and digital reporting challenges. EY global network and teams in over 150 countries provide help for clients to grow, transform and operate. (...)

Kofax enables organizations to Work Like Tomorrow™—today. Kofax’s Intelligent Automation software platform and solutions digitally transform document intensive workflows. Customers realize greater agility and resiliency by combining (...)

OpenPeppol is a non-profit international association responsible for the governance and maintenance of the Peppol specifications that enable European businesses to easily deal electronically with any European public sector buyer in their (...)

PwC's Global e-Invoicing and e-Archiving Network brings together process, technology, tax, legal and accounting experts making your E-Invoicing business case reality! For over 15 years now, PwC has been at the forefront of e-Invoicing (...)

As the world’s largest provider of enterprise application software, SAP (NYSE: SAP) helps companies of all sizes and industries run better. From back office to boardroom, warehouse to storefront, desktop to mobile device (...)

Founded in 2006, SNI currently has over 100 employees, operating across multiple locations in Europe. We offer SAP and Peppol certified solutions (SAF-T, Invoice Reporting, VAT Reporting and e-Invoicing) to more than 750 clients - thereof 70% multinational. (...)

No matter what size organisation, whether you are focused on domestic VAT calculations and returns, or managing compliance across multiple jurisdictions, Thomson Reuters ONESOURCE indirect tax technology simplifies solving global, tax challenges. With Thomson Reuters, corporations can manage tax calculations and returns (...)

At Valta Technology Group we believe that everything a business does should be simple and drive measurable value. To drive simplicity and value, we focus on uniting the right technology, the right services and process together. (...)

Media

Fintech News Singapore provides a source of timely, deep insights and the latest local and global news about Fintech. Launched in 2015, the Fintech News Network team works very hard to deliver fintech-centric content in various forms to an audience looking for updates on fintech events and webinars, stunning opinions from highly-reputable digital finance innovators, analysis on fintech applications from active insiders, breaking news on fintech topics and fintech market alerts.

The Invoicing Hub is your free and trusted source of fresh information on e-invoicing. The Invoicing Hub publishes authentic and objective news, including details on the many B2G & B2B e-invoicing and e-reporting mandates. The Invoicing Hub also offers detailed and practical country-specific overviews complemented by links to official and useful resources, as well as comprehensive ecosystem listings.

VATupdate.com collects and publishes VAT-related news from all around the world. The website exists since 2018 and is made by and for VAT-enthusiasts. The website continuously provides updates on VAT regulations, VAT rates, case-law, events, job opportunities, tax technology and tools, and trends and developments (such as VAT e-invoicing requirements).

Besides the core members in the Netherlands and Belgium, the VATupdate Team consists of various independent contributors from all over the world. News items are posted on the website, but also on LinkedIn, Twitter and in the weekly newsletter.