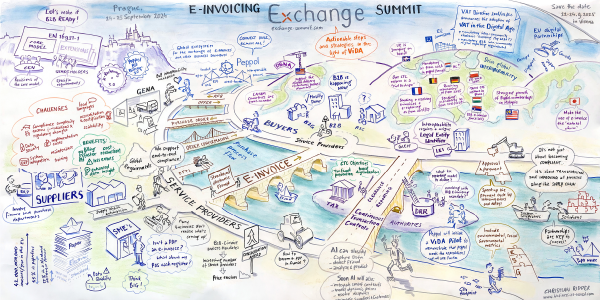

Review E-INVOICING EXCHANGE SUMMIT Kuala Lumpur 2024

Key Takeaways from the E-Invoicing Exchange Summit APAC 2024

The E-Invoicing Exchange Summit APAC 2024 in Kuala Lumpur, held from November 25 to 27, brought together over 150 participants from 20 countries. Over three days, the summit featured engaging workshops, thought-provoking presentations, expert panel discussions, and collaborative roundtables, establishing itself as an important event for E-Invoicing professionals in the region.

The event was officially opened by YB Datuk Wilson Ugak Kumbong, Deputy Minister of Digital, whose keynote highlighted the vital role of digital transformation in enhancing business efficiency and fostering international collaboration. His remarks set the stage for an agenda that explored the latest developments and future opportunities in interoperable E-Invoicing.

Key themes included global interoperability frameworks, automation in financial processes, and the broader role of E-Invoicing in digital transformation. The event provided a unique opportunity to connect with stakeholders across the E-Invoicing ecosystem, exchanging perspectives on harmonized systems that streamline compliance and support international trade. Discussions underscored the role of E-Invoicing in improving efficiency, enabling innovation, and supporting sustainability, also with a particular focus on benefits for SMEs.

We sincerely thank all participants, speakers, partners, and everyone involved for their invaluable contributions to the success of this edition of the E-Invoicing Exchange Summit. A special note of gratitude goes to the Malaysia Digital Economy Corporation (MDEC) for their outstanding support.

The E-Invoicing Exchange Summit will return to the region in November 2025.

To access the presentation slides, click here and stay informed with our E-Invoicing News.

Agenda E-Invoicing exchange summit Kuala lumpur 2024

Workshop Day - November 25, 2024

09:30 - 12:30

Workshop A

GENA Academy Essentials: Everything You Always Wanted to Know About E-Invoicing, but Were Afraid to Ask

Delve into the enigmatic world of E-Invoicing, where seemingly humble administrative documents wield unparalleled influence. This session will unravel the complexities of E-Invoicing, covering essential topics including:

+ Terms and Abbreviations: Decipher the jargon and acronyms.

+ E-Invoicing as a Business Process: Explore how E-Invoicing transcends mere paperwork to become a cornerstone of modern business operations.

+ Why Small Businesses are the Elephant in the Room: they aren't at the table, yet they dominate the debate.

+ Why Governments Care (A Lot): Understand why tax and other regulators simply cannot leave the invoice alone.

+ Supporting Characters: Meet the other crucial actors that contribute to the E-Invoicing ecosystem.

+ Models and Frameworks: Discover the diverse array of business and regulatory models and frameworks that shape E-Invoicing.

+ Regional, Sectoral, and Cultural Differences: how regional, sectoral, and cultural factors influence its implementation and adoption.

+ Global interoperability: The GENA/Peppol incubation project

Workshop conducted by Christiaan van der Valk Vice Chair and Richard Luthardt Board Member German Chapter, GENA - Global Exchange Network Association and Lefteris Leontaridis Operations Manager, OpenPeppol

13:30 - 16:30

Workshop B

Global Interoperability and the Peppol International Invoice

+ Global interoperability supporting international trade

+ Understanding the Peppol International Invoice (PINT)

+ Latest Update on the progress in APAC in adopting the Peppol International Invoice

Workshop conducted by Steve Graham Market Development Lead and Erwin Wulterkens Portfolio Manager, OpenPeppol

17:00 - 20:00

ICEBREAKER RECEPTION supported by SNI

Your networking experience starts right here. All participants and speakers are invited to attend the Icebreaker Reception and to pick up their badges for the two conference days.

Conference day 1 - November 26, 2024

09:35 - 09:50

Welcome and Opening

Johannes researches, organizes and runs knowledge and networking platforms that help the industry to benefit from new technologies and cope with changing legal and regulatory frameworks. His events make sure that all stakeholders learn, discuss and network with like-minded experts, practitioners and thought leaders. His main focus lies on E-Invoicing since 1999, carrying out the E-Invoicing Exchange Summits in Europe, Asia and the US, the E-Rechnungs-Gipfel in Germany, and the Swiss Payment Forum in Zurich.

Read more on LinkedIn

Johannes von Mulert Founder and Chairman E-Invoicing Exchange Summit

09:50 - 09:55

Host Country Opening Remarks

YBrs. En. Anuar Fariz Fadzil Chief Executive Officer, Malaysia Digital Economy Corporation (MDEC)

09:55 - 10:10

Opening Keynote

YB Datuk Wilson Ugak Kumbong Deputy Minister of Digital

10:10 - 10:20

Malaysia's E-Invoicing for Business Digitalisation

YBhg. Datuk Fadzli Abdul Wahit Head of Digital Transformation, MDEC

10:20 - 11:00

Global Update on Peppol

André Hoddevik Secretary General, OpenPeppol

11:45 - 12:15

Figures, Data, Facts: The Latest Developments in Europe including ViDA (VAT in the Digital Age) and globally

This session will explain the current and future adoption rates for E-Invoicing as well as the main influencing factors and the effects it has on all stakeholders such as companies, service providers, tax authorities and associations.

Marcus Laube CEO, billentis and Secretary General, GENA - Global Exchange Network Association

12:15 - 12:45

The Good, the Bad – and the Future of our Industry

Raymond and Phil will debate perspectives from each corner of the industry, including suppliers, buyers, technology partners, advisors, and regulators.

+ Business: what’s keeping small businesses up at night; and, what’s the size of the challenge for big corporates. How to unlock ‘free of charge’ automation

+ Tax authorities: should regulators go even further? Discover the hidden road to economic growth

+ Technology providers: what is said versus what is delivered. How true interoperability is the key to scale and innovation

+ The changing world and the evolution of tax, finance & supply chains in an AI-driven world

Phil Bailey Head of Network Expansion and Raymond Lam Managing Director ASEA, Pagero

14:00 - 14:30

Efficiency Redefined: E-Invoicing as a Catalyst for Process Automation

Fritz Hu and Peter Heb Global Account Managers, Edicom

Ariel Poh Partner Manager, Google

14:30 - 15:00

Roundtable Sessions

Discuss the most pressing business-relevant topics with your peers and gain valuable information.

More roundtables to be published soon.

1. Just around the Corner: Latest Update on B2B Mandate in Germany

Ivo Moszynski Chair of FeRD (German Forum for Electronic Invoicing) and

Richard Luthardt Board Member German Chapter, GENA and Member of the Board of VeR (German E-Invoicing Association), Germany

2. The 4-Corner Model for E-Invoice Exchange

The term "4-corner model" is bandied about throughout our community and it represents essential network topology concepts in document interchange interoperability. But not everyone has heard or has understood the term before. This roundtable session visually demonstrates for non-technical audiences the important principles of different network topologies and why the 4-corner model works so very well for the exchange of electronic invoices and other documents.

Ken Holman CTO, Crane Softwrights, Canada

3. E-Invoicing and Tax Reporting with SAP

Mervyn Ichsan Senior Product Manager, SAP Globalization Services, SAP, Singapore

4. The Economic and Organisational Benefit of Implementing and Adopting eInvoicing

Warren Meyer Director, Deloitte Asia Pacific Tax and Legal eInvoicing and eReporting Leader

15:30 - 16:00

DBN-Alliance Exchange Framework: The Global Digital B2B Highway in North America

Mimi Stansbury Treasurer and Dolf Kars Chairman, DBN-Alliance

16:00 - 16:45

Panel Discussion

Driving Digitalisation across APAC with Internationally Interoperable E-Invoicing

Craig Smith Director New Zealand Peppol Authority, Ministry of Business Innovation and Employment, New Zealand

Seong Wah Geok Principle Architect E-Invoicing, IMDA, Singapore and Peppol eDEC Leader

Saiful Izwan Mohd Shazali Director National E-Invoicing and Standardisation, Malaysia Digital Economy Corporation (MDEC)

Hiroyuki Kato Director, Digital Agency, Government of Japan

Fawad Abro Assistant Commissioner, eInvoicing, Australian Taxation Office

Moderated by: Song Hock Koon Senior Advisor of National E-Invoicing & Standardisation, Malaysia Digital Economy Corporation (MDEC)

16:45 - 17:00

Unlocking SME Productivity with E-Invoicing: Driving Adoption Beyond Tax Compliance

Simon Foster Global Director of E-Invoicing, Xero

18:00 - 21:30

Networking Dinner supported by Xero

All participants and speakers are invited to enjoy dinner and refreshments in a casual atmosphere. Use this perfect opportunity to intensify your business contacts and grow your network.

Conference day 2 - November 27, 2024

09:00 - 09:30

Mastering E-Invoicing Now: Actionable Steps for Compliance and Efficiency

This session will discuss the state-of-play for E-Invoicing mandates and what lessons can be learnt from regions that have already implemented E-Invoicing. Learn how E-Invoicing can help you transform your AR and AP functions with discussion of the typical challenges of E-Invoicing implementation projects and the obvious and not-so-obvious mistakes in early stages of implementation.

Alex Baulf Vice President, Global Indirect Tax & E-Invoicing, Avalara

09:30 - 10:00

Progress Report: E-Invoicing in Japan

Hiroyuki Kato Director, Digital Agency, Government of Japan

10:45 - 11:15

Big Data vs Big Brother - How Mirror Visibility Drives Indirect Tax Consolidation

Christiaan van der Valk GM Indirect Taxtech & VP Regulatory and

Alex Pavel MD APAC & Middle East, Sovos

11:15 - 11:45

Country Update Singapore: Gearing up the E-Invoicing Ecosystem for the GST InvoiceNow Requirement

Bill Xiao Deputy Director, E-Invoicing Project Office, IMDA, Singapore

11:45 - 12:15

Malaysia's E-Invoicing for Tax Compliance

Dr. Rasyidah Che Rosli Director of E-Invoice Division, Tax Operations Department, Inland Revenue Board of Malaysia

Watch video message

13:30 - 14:00

E-Invoicing in India: Facts, Figures & Experience on Adoption of E-Invoicing and Reporting Requirements

Atul Gupta Chairman GST Committee at FII (Federation of Indian Industry) and Board Member IFAC (The International Federation of Accountants) and XBRL International, India

14:00 - 14:30

Latest Update on E-Invoicing Adoption in New Zealand

Craig Smith Director New Zealand Peppol Authority, Ministry of Business, Innovation and Employment

14:30 - 15:00

Energy Supply Chain Network: Rising Above E-Invoicing and Financial Compliance

Mimi Stansbury CEO, OFS Portal

Watch video message

15:30 - 17:00

Service Provider Community Meeting

Kick-off Session GENA APAC

+ Discussing APAC E-Invoicing Requirements

+ Possible agenda or the local service provider community

+ Networking with the community

moderated by Marcus Laube Secretary General, GENA - Global Exchange Network Association

Industry Partners

When Tony Alvarez and Bryan Marsal joined forces in 1983, it was with the intent of seamlessly linking operations , performance improvement and value creation to best help companies (...)

Avalara empowers organizations of all sizes and numerous business sectors to automate work in their finance departments, boost efficiency of their administrative operations, and achieve compliancy (...)

When Binary Semantics took its first step in 1986, it was with an unwavering vision to harness technology's power to help companies turn areas of stagnation into growth. This pioneering spirit (...)

cbs is a global consulting practice that originated in Germany with over 3000 international projects over the last 25 years. We advise the world’s most notable companies: renowned, highly innovative customers and hidden champions of the (...)

Our mission at ClearTax is to simplify finances, save money and time for millions of businesses. We are a tax & technology company that builds trusted, useful and insightful platforms for our clients (...)

Edicom is a global leader in E-Invoicing, EDI, and VAT compliance solutions. With nearly twenty-five years of experience, over 15,000 clients, and projects in 80 countries Edicom can manage any B2B or B2G communications project. (...)

At OFS Portal, we are proud pioneers in revolutionizing B2B eCommerce integrations for Energy Industry suppliers and service providers. Founded by twelve leading oilfield services firms, including (...)

Pagero provides a Smart Business Network that connects buyers and sellers for automated, compliant, and secure exchange of orders, invoices, payment instructions and other business documents. With an open network (...)

OpenPeppol is a non-profit international association responsible for the governance and maintenance of the Peppol specifications that enable European businesses to easily deal electronically with any European public sector buyer in their (...)

As the world’s largest provider of enterprise application software, SAP (NYSE: SAP) helps companies of all sizes and industries run better. From back office to boardroom, warehouse to storefront, (...)

Skill Quotient Technologies is an innovative IT company working on cutting-edge technologies for SMARTeIS e-invoicing Solutions, Cyber Security Services, Application Testing Services, (...)

Founded in 2006, SNI currently has over 100 employees, operating across multiple locations in Europe. We offer SAP and Peppol certified solutions (SAF-T, Invoice Reporting, VAT Reporting and e-Invoicing) to more than (...)

Sovos is a global provider of tax, compliance and trust solutions and services that enable businesses to navigate an increasingly regulated world with true confidence. Purpose-built for always-on compliance (...)

Storecove is a provider of E-Invoicing connectivity and was founded in 2019. Large organisations and ERP systems worldwide use Storecove to send and receive invoices via the Peppol network. (...)

Tungsten Automation, formerly Kofax, is the global leader in intelligent workflow automation solutions with a trusted legacy of 40 years, with a team of 2,200 employees in 32 countries, serving 25,000+ global customers. Our commitment (...)

Xero is a global small business platform with 4.2 million subscribers. Xero’s smart tools help small businesses and their advisors to manage core accounting functions like tax and bank reconciliation (...)

Supported by

GENA stands as an international trade association, embodying a vibrant and expansive community of Service Providers originating from various sectors, including network services, business outsourcing, financial services (...)

Media

Fintech News Singapore provides a source of timely, deep insights and the latest local and global news about Fintech. Launched in 2015, the Fintech News Network team works very hard to deliver fintech-centric content in various forms to an audience looking for updates on fintech events and webinars, stunning opinions from highly-reputable digital finance innovators, analysis on fintech applications from active insiders, breaking news on fintech topics and fintech market alerts.

The Invoicing Hub is your free and trusted source of fresh information on e-invoicing. The Invoicing Hub publishes authentic and objective news, including details on the many B2G & B2B e-invoicing and e-reporting mandates. The Invoicing Hub also offers detailed and practical country-specific overviews complemented by links to official and useful resources, as well as comprehensive ecosystem listings.

VATupdate.com collects and publishes VAT-related news from all around the world. The website exists since 2018 and is made by and for VAT-enthusiasts. The website continuously provides updates on VAT regulations, VAT rates, case-law, events, job opportunities, tax technology and tools, and trends and developments (such as VAT e-invoicing requirements).

Besides the core members in the Netherlands and Belgium, the VATupdate Team consists of various independent contributors from all over the world. News items are posted on the website, but also on LinkedIn, Twitter and in the weekly newsletter.